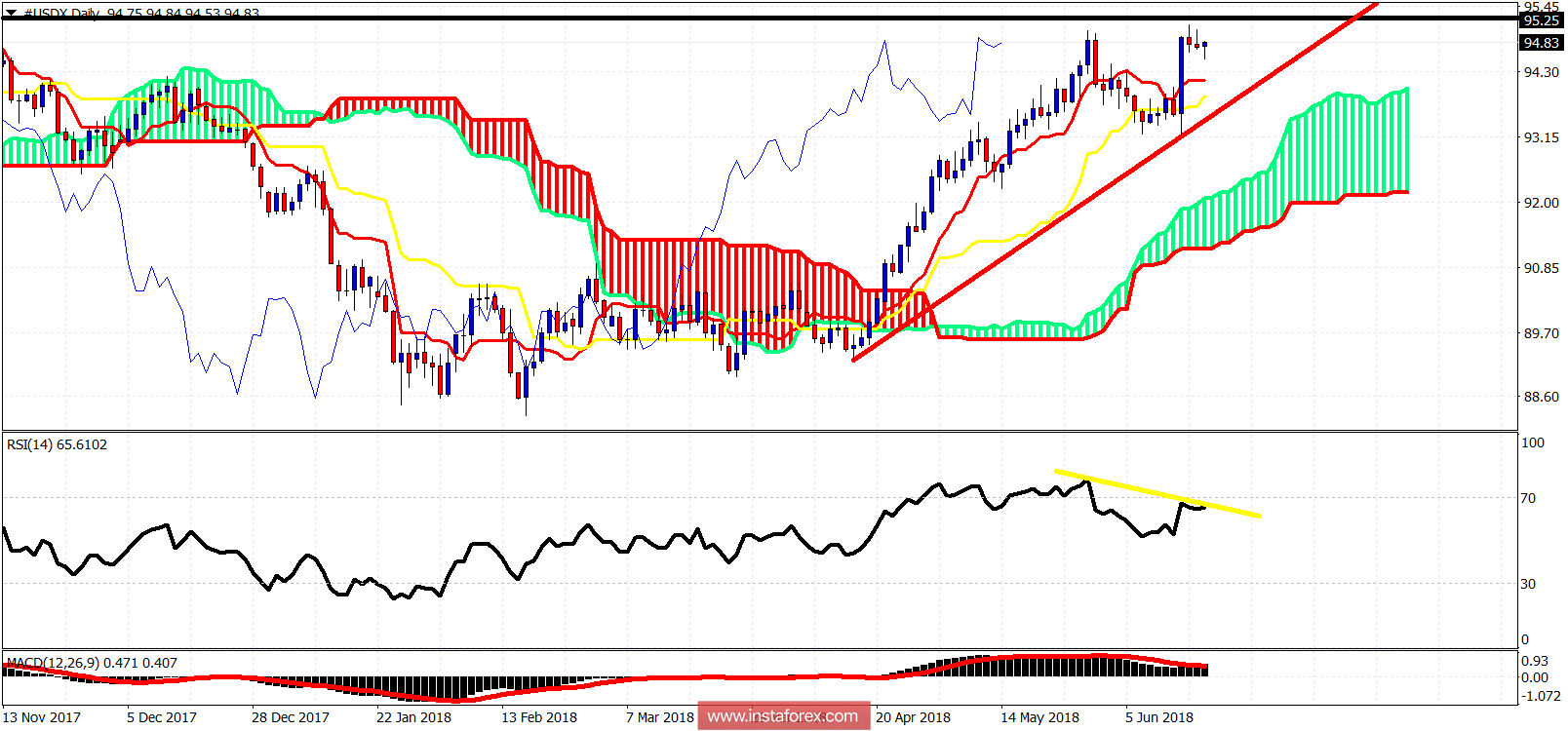

The Dollar index remains near its highs. Trend remains bullish. There are bearish divergence signs that provide a warning for Dollar bulls. Short-term support at 94.20-94 is important for the short-term trend. As long as price is above this level we could see a move higher towards 95.70. The next big move in the Dollar index will be to the downside.

Red line - support

Yellow line - bearish divergence

The new high in the Dollar index was not confirmed by the RSI. This is not a reversal signal but only a warning for bulls. For this up trend to remain intact, the index must not break below 93.20. A break below 93.20 will confirm that the trend has changed to bearish. I expect the Dollar index to make an important change of trend similar to the start of the year bottom and upward reversal, only this time to the downside.