AUD/USD has been quite impulsive with the bullish gains today which lead the price to bounce off the 0.74 area and pushed towards 0.7500-50 area. Despite having no impactful economic reports on AUD side, the weakness of USD for the recently published worse reports is stated as a culprit for the current scenario.

AUD has been quite indecisive with the recent economic reports and events which lead the currency to get dominated by the USD earlier. But due to worse economic reports of USD published yesterday, AUD gained impulsive momentum today which is expected to persist further in the coming days.

On the USD side, today USD Flash Manufacturing PMI report is going to be published which is expected to decrease to 56.3 from the previous figure of 56.4 and Flash Services PMI report is expected to decrease to 56.4 from the previous figure of 56.8.

As of the current scenario, if the USD economic forecasts turn out to be actual or worse than that, AUD is expected to gain further momentum over USD in the coming days. Though such bullish momentum is currently summed up as certain retracement in the pair whereas the bearish trend is still quite strong. To sum up, AUD is expected to gain short to medium-term momentum over USD for the coming days.

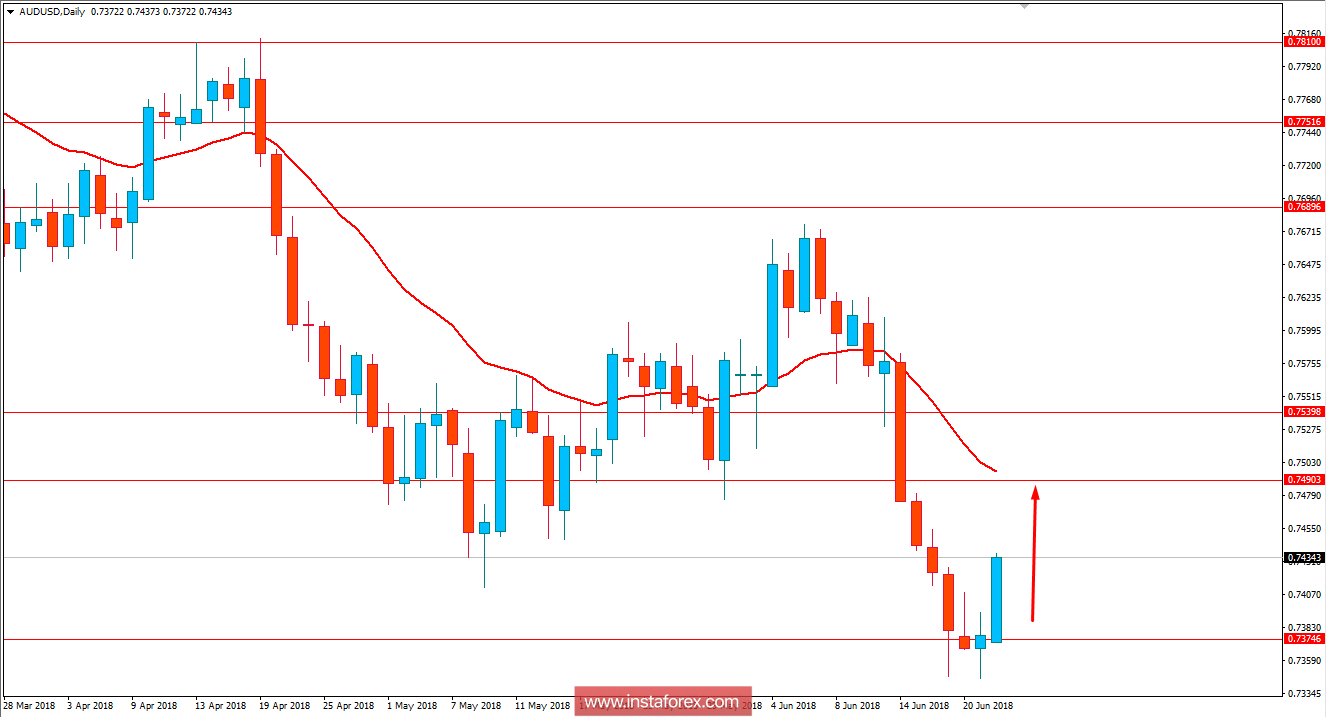

Now let us look at the technical view. The price is currently impulsive with the bullish pressure which is expected to push higher towards 0.7500-50 area in the coming days. As the price reach the 0.7500-50 area, certain confluence can be observed from the dynamic level of 20 EMA which might lead to a continuation of further bearish pressure in the pair for the future. As the price remains below 0.7750 with a daily close, the bearish bias is expected to continue further.