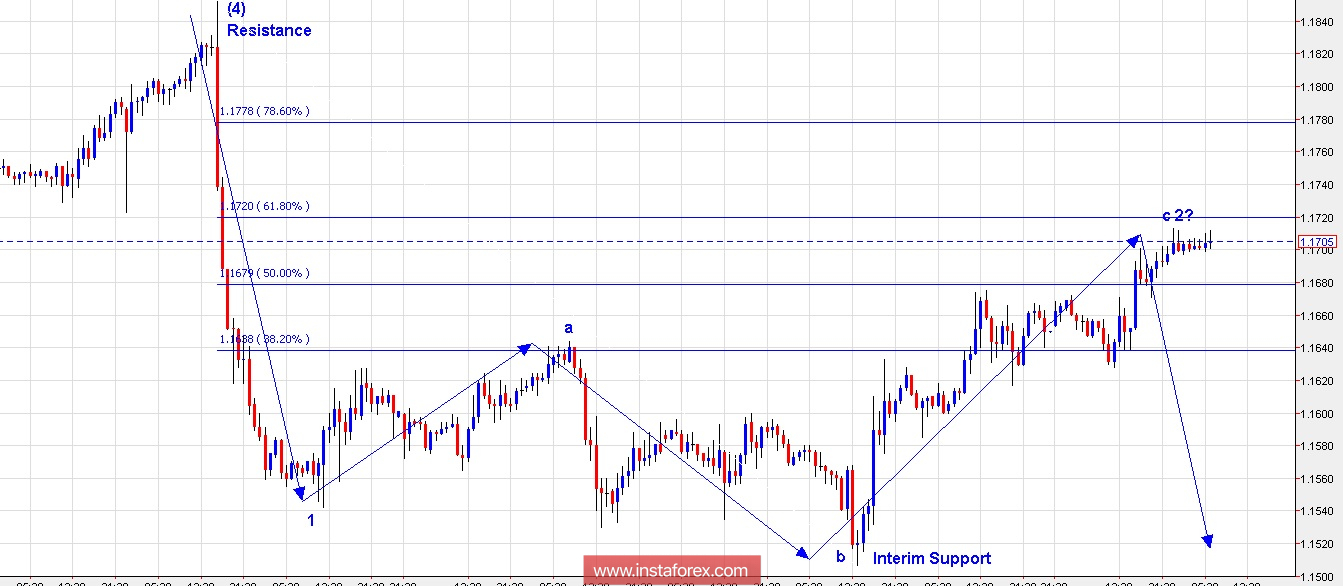

Technical outlook:

A short-term hourly picture has been brought up here to have a look at the most probable count. We are still safe to assume that wave (4) terminated at 1.1850 earlier and that the (5)th wave has resumed lower. The subsequent rally seems to be an expanded flat (3-3-5) structure labeled as a-b-c here; which is corrective. Furthermore, prices are stalling just ahead of the Fibonacci 0.618 resistance around 1.1720 levels. The pair has made an overnight high at 1.1713 on charts and is seen to be trading around 1.1705/08 at this point of writing. If this scenario holds true, prices should reverse from around these levels soon enough and continue drifting lower below 1.1500 levels. On the flip side, if a more complex wave (4) correction is due to take place, bulls would rally past 1.1850 levels easily.

Trading plan:

Short now (1.1710/20), stop above 1.1850, target 1.1300.

Fundamental outlook:

Watch out for US Consumer confidence at 10:00 AM EST.

Good luck!