The beginning of the week deteriorated trading sentiment in financial markets. Strong price drops are unfolding in the stock markets in the US and Europe in response to the Treasury Department's announcement of planned restrictions on Chinese companies of new technologies. In spite of the calm statement of US President's Trade Adviser Peter Navarro, it can not be ruled out that Monday's slumps were an introduction to a more serious correction of overvalued stocks on global trading floors.

The currencies of emerging markets are currently in retreat and their weakness from the last few tens of trading hours is clearly global. It is related to the general risk reversal and the Chinese yuan's rebate following a weekend reduction in the reserve requirement of banks made by the People's Bank of China. Although the decision was not a surprise, the reaction to this event was dominated by fears that if the central bank enters the game, the situation in the economy may be worse than the official statistics show. Following the yuan, the South Korean won, South African rand as well as Indian and Indonesian rupees - all countries with strong economic ties with China - are clearly missing from the beginning of the week.

Interestingly, the dollar is not particularly under pressure from buyers this week, but the trend is not going to change. On the other hand, this is generally bad news for emerging markets. It does not change the fact that the euro is laboriously recovering losses generated after the decision of the European Central Bank. The question remains, whether this situation will continue for a longer period of time, or if this is just a temporary lack of the Intermarket correlation.

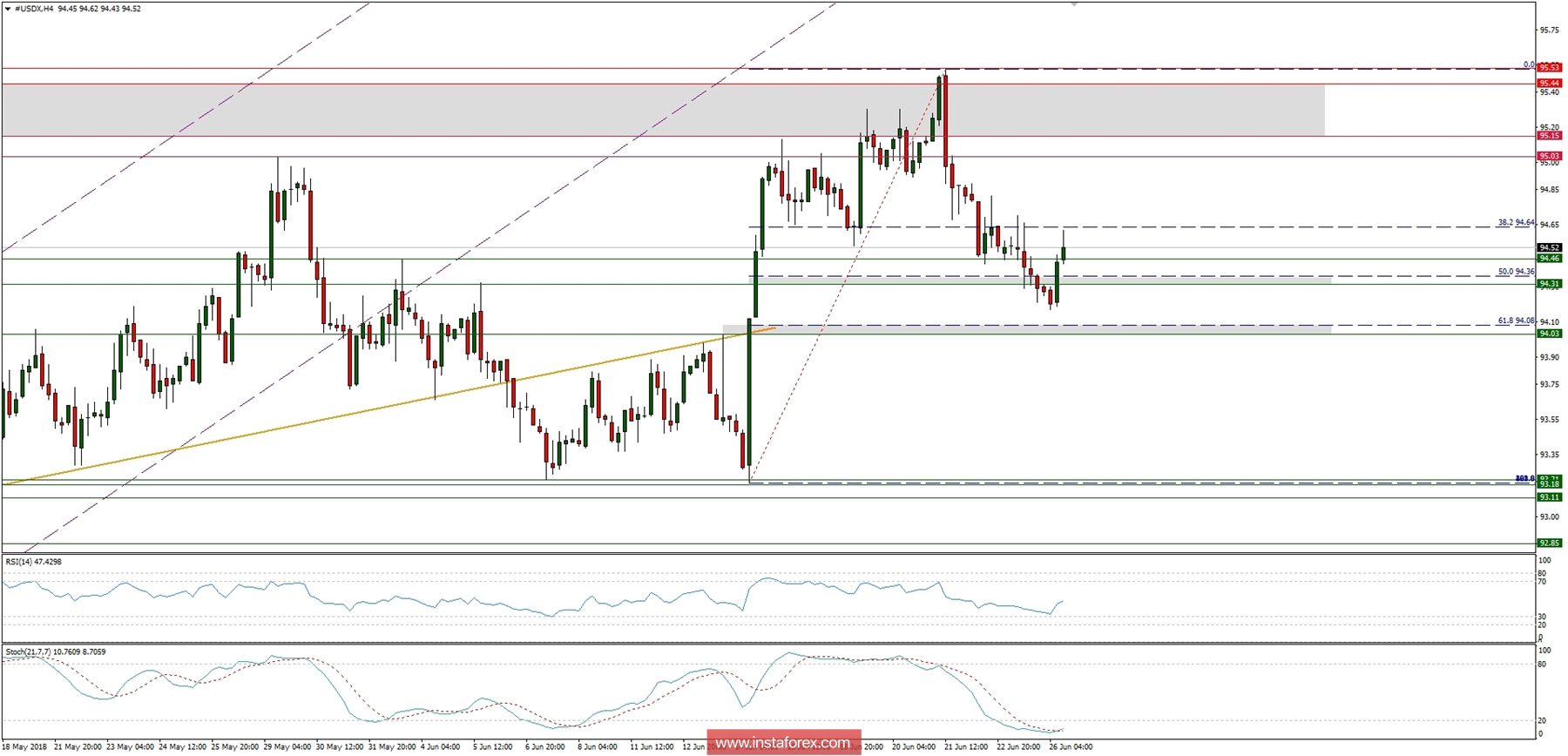

Let's now take a look at the US Dollar Index technical picture at the H4 time frame. The market has violated the 50% Fibo at the level of 94.36, but the bears did not manage to push the price toward the 61% Fibo at 94.08 yet. Currently, the market conditions are oversold, so a short-term internal pull-back should be expected. The immediate resistance is seen at the levels of 94.64 and 95.00. Please notice, that the longer time frame trend is still up and there are no signs of a trend reversal yet.