EUR/JPY has been quite volatile and indecisive recently which led to certain correction below 129.50 area after a breakout. EUR and JPY have been quite indecisive amid the recent economic reports and events which triggered correction and higher volatility in the market. As a result, the pair has been trading with no definite trend pressure.

As the Brexit impact is still putting pressure on the EUR the growth, the ECB could not provide enough support for a further EUR rally in its recent meetings. As there is no possibility of a rate hike this year, 2019 seems to be a very long-term prospect for investors. So, EUR is already losing steam. Ahead of the ECB Economic Bulletin and EU Economic Summit, EUR is expected to remain almost flat against JPY for the time being.

On the other hand, today Japan's SPPI report was published unchanged as expected at 1.0% and BOJ Core CPI was also published unchanged at 0.5% which was expected to increase to 0.6%. Ahead of the upcoming Retail Sales, Unemployment Claims and Unemployment Rate report to be published this week, certain volatility is expected to persist in the pair.

As for the current scenario, JPY is expected to regain momentum over EUR amid macroeconomic reports which are due later this week. Though events in the eurozone this week are likely to be of little importance for EUR gains, JPY is will take the lead to gain momentum.

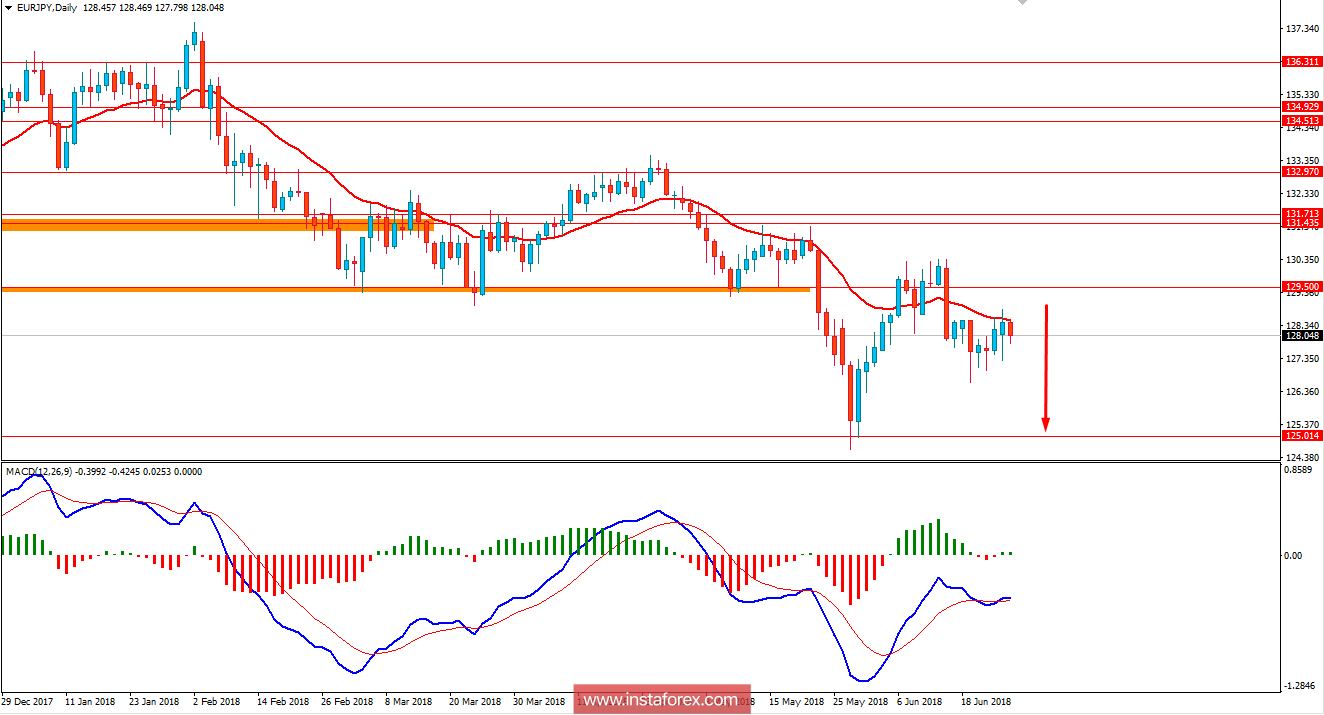

Now let us look at the technical view. The price is currently being held by the dynamic level of 20 EMA after a correction below 129.50 area. Apart from the confluence of the dynamic level, there is no definite momentum in the market. As the price remains below 129.50 with a daily close, the price is expected to continue pushing lower with a target towards 125.00 area in the coming days.