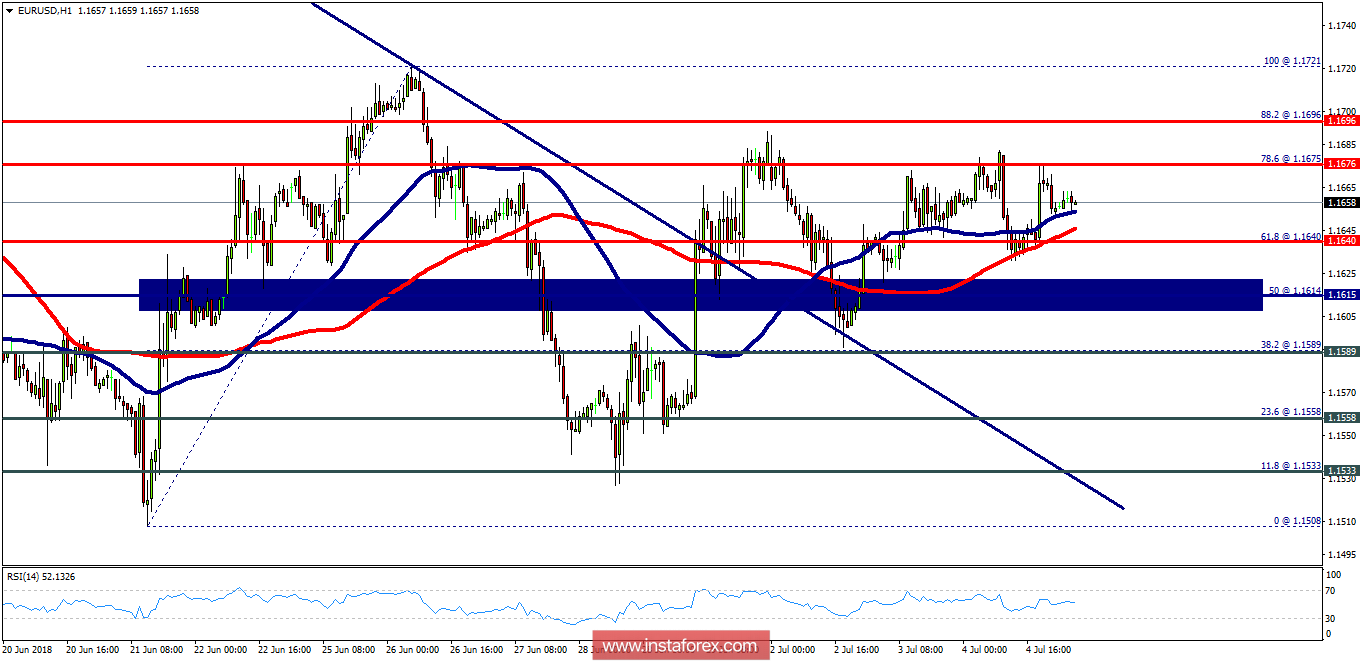

Pivot: 1.1615.

The EUR/USD pair continues to move upwards from the level of 1.1615. Yesterday, the pair rose from the level of 1.1615 to a top around 1.1650. Today, the first resistance level is seen at 1.1676 followed by 1.1696, while daily support 1 is seen at 1.1614 (50% Fibonacci retracement). According to the previous events, the USD/CHF pair is still moving between the levels of 1.1615 and 1.1696; so we expect a range of 81 pips. Furthermore, if the trend is able to break out through the first resistance level at 1.1675, we should see the pair climbing towards the double top (1.1721) to test it. Therefore, buy above the level of 1.1614 with the first target at 1.1675 in order to test the daily resistance 1 and further to 1.1696. Also, it might be noted that the level of 1.1721 is a good place to take profit because it will form a double top. On the other hand, in case a reversal takes place and the USD/CHF pair breaks through the support level of 1.1610, a further decline to 1.1530 can occur which would indicate a bearish market.