The German Federal Ministry of Finance believes that the concept of the Central Bank's digital currency (CBDC) is too risky to be able to implement it. The Ministry of Finance expressed its position in response to a query by Gerard Schick published in one of the financial newspapers.

The German Ministry stated: "so far, there are no convincing reasons to spend digital money from the central bank for a wide range of users in Germany and the Eurozone".

The potential benefits of the Central Bank's digital currency - including quick bank transfers - could also be implemented in a different way - the Ministry says - saying that CBDC contains many risks that are not well understood.

The ministry wrote that the central bank would also gain a stronger position in the financial system if it were to issue a cryptocurrency, which could jeopardize its independence. According to Handelsblatt, the Ministry of Finance was also afraid that in a crisis situation, bankruptcy with central bank money could take place faster and on a larger scale due to lower transaction costs. Officials also say that the digital currency would make it difficult to fight money laundering and terrorism financing.

Governments around the world have expressed different opinions about the digital currency issued by the state. In May, the Bank of England stated in a working document that the introduction of CBDC will not have a negative impact on private loans or ensure the liquidity of the entire economy.

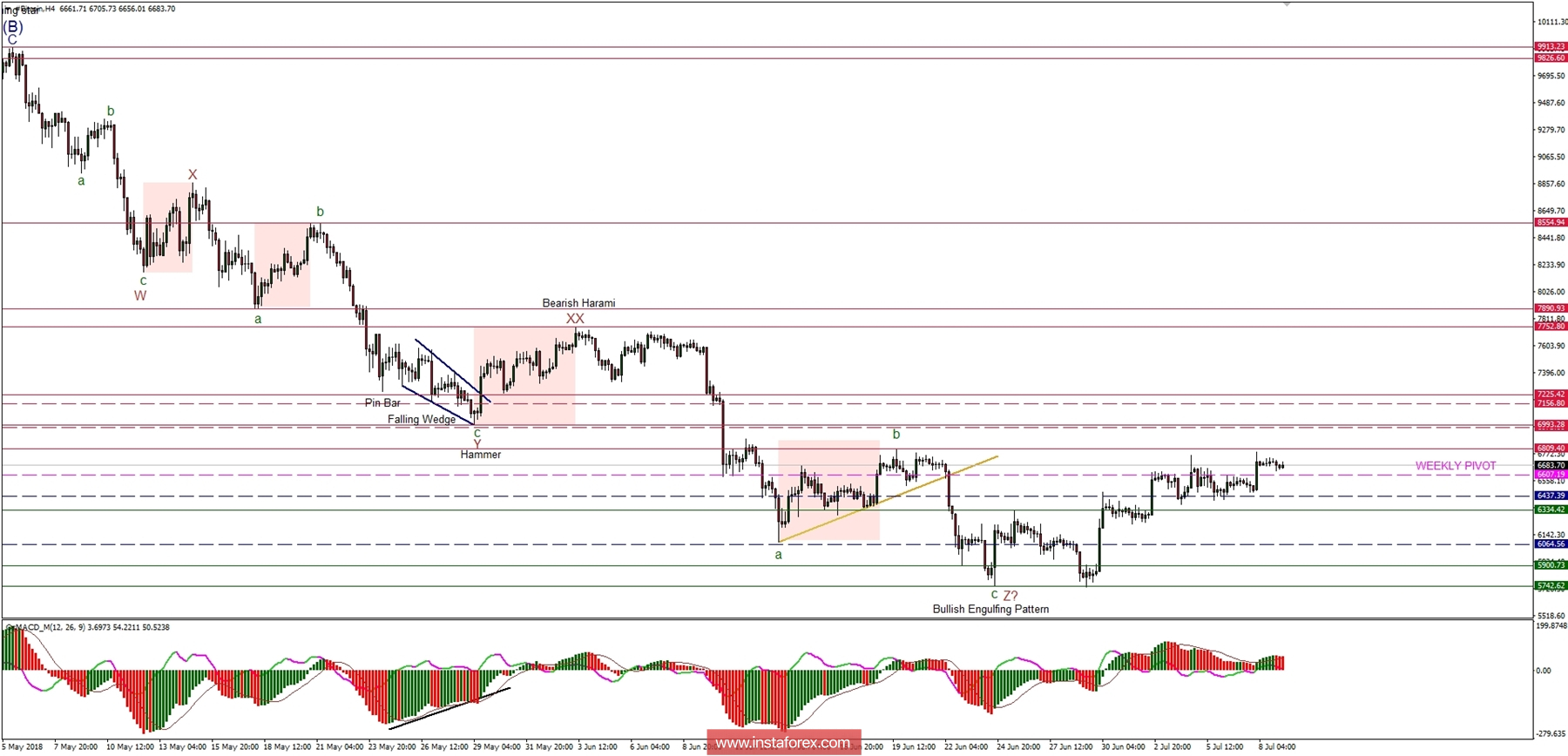

Let's now take a look at the Bitcoin technical picture at the H4 time frame. The market remains locked between the levels of $6,334 and $6,809 and is trading in a tight horizontal consolidation. In a case of the bullish breakout higher above the level of $6,809, the next target for bulls is located at the level of $6,993, which is an important technical resistance level. If, however, the bears will take the control over the market, then the next target for them is located at the level of $5,900. Due to a strong and positive momentum, the preferred scenario is still bullish.