EUR/USD has been quite impressive with bullish gains today after correction and volatility along the way. Despite downbeat economic results today, EUR managed to gain momentum over USD.

Today Spanish Unemployment Change report was published with an increase to 52.2k from the previous figure of 20.4k and Sentix Investor Confidence decreased to 8.8 from the previous figure of 11.4 which was expected to be at 9.9. The European Union and the UK are still running the negotiation to strike the Brexit deal which might impact the upcoming gains of the currency. Despite the jitters about the Italian budget deficit, EUR gain today was quite remarkable which indicates the market sentiment against USD.

On the other hand, in light of the positive employment change report, USD could not perform as per expectation which encouraged gains of EURO side currently. Today US Final Services PMI report was published with a slight increase to 54.8 which was expected to be unchanged at 54.7 and ISM Non-Manufacturing PMI was published with a decrease to 60.3 from the previous figure of 61.6 which performed better than the forecast of 59.3 which did not signal much improvement.

Meanwhile, ahead of the policy update by the Federal Reserve and FOMC Statement this week on Friday, USD is expected to struggle further against EUR. Any positive economic data which is due this week in the eurozone is expected to increase the impulsiveness of the bullish gains. Until the US comes up with better and consistent economic reports, EUR gains may lead to certain volatility in the pair in the coming days.

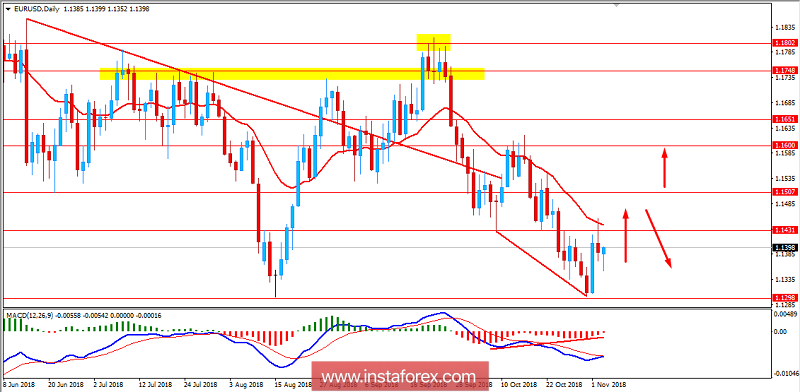

Now let us look at the technical view. The price has been quite impressive with the bullish gains today which is currently heading towards 1.1430-1.1500 area. If any bearish pressure is observed, the price has a greater probability to continue with the bearish trend with a target towards 1.1300 support area in the coming days. Otherwise, a break above 1.1500 is expected to lead the price towards 1.1600-50 resistance area in the future. As the price remains below 1.1500 area with daily close, the bearish bias is expected to continue.

SUPPORT: 1.1300

RESISTANCE: 1.1430, 1.1500, 1.1600-50

BIAS: BEARISH

MOMENTUM: CORRECTIVE and VOLATILE