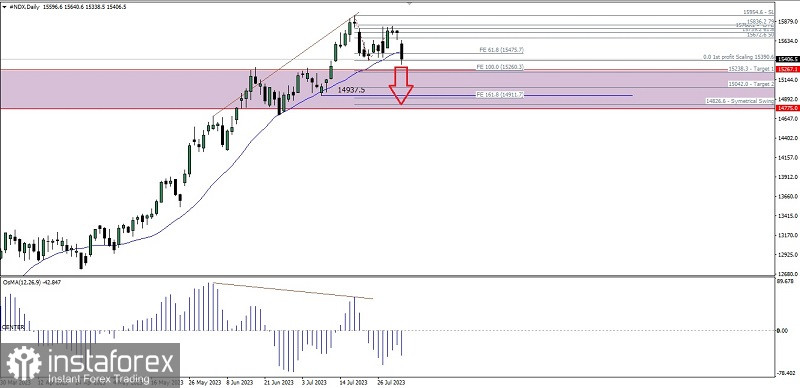

As we can see on its daily chart of Nasdaq 100 index, there is the appearance of Bearish 123 pattern followed by Ross Hook (RH) which managed to break below, as well as the price movement already breaks below WMA 20 and is supported by the appearance of deviations between price movements and the MACD Histogram indicator so in the next few days as long as there is no upward rally movement past the 15954.6 level then #NDX has the potential to be corrected down to the level 15260.3 as the main target and the level 14911.7 as the target both of them.

(Disclaimer)