Ahead of NFP reports today with bearish expectations, NZD managed to sustain its gains versus USD. Positive economic reports from New Zealand and optimistic approach from RBNZ has helped the currency to sustain its gains further.

The US Federal Reserve raised interest rates 4 times in 2018, citing healthy domestic economy, solid consumer confidence, falling wholesale prices, and wobbling of financial markets. Currently the US FED is taking a patient approach, keeping the rates unchanged for most of 2019 with a slim chance of maximum 2 rate hikes this year. The US-China trade war and the partial government shutdown are assumed to be the main reason for USD to lose momentum against NZD recently. Today US Average Hourly Earnings report is going to be published which is expected to decrease to 0.3% from the previous value of 0.4%, Non-Farm Employment Change is expected to decrease to 165k from the previous figure of 312k, and Unemployment Rate is expected to be unchanged at 3.9%. The weekly unemployment claims rise indicates the negative situation on the labor market, alongside expectations of contraction in NFP. If the forecasts come true, downbeat readings today will push USD down.

On the NZD side, the latest positive trade balance report showed an increase to 264M from the previous figure of -955M which was expected to be at 255M. This significant change in the trade balance helped the currency to attract market sentiment, leading to sustainable gains in the process.

Meanwhile, NZD is expected to sustain its gains over USD but any better outcome in the US NFP report, which is currently quite unlikely, may lead to a counter-move in the coming days.

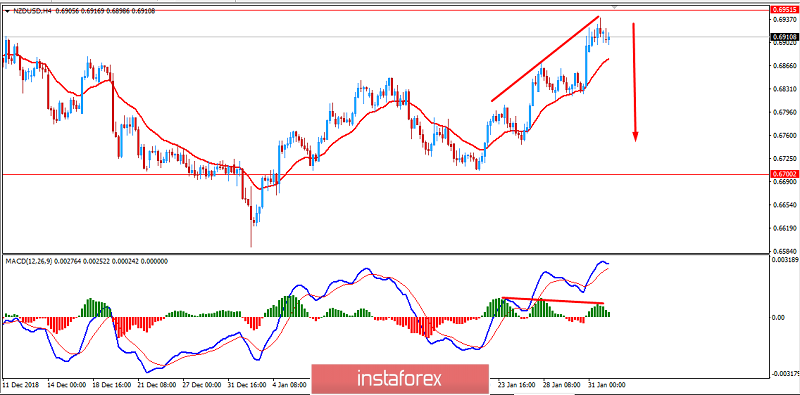

Now let us look at the technical view. The price has formed a Bearish Divergence in the MACD Histogram recently while climbing towards 0.6950 resistance area currently. As the price remains below 0.70 area with a daily close, there is a chance of a bearish counter-move which might lead the price lower towards 0.6700 support area in the coming days.

SUPPORT: 0.6500, 0.6650, 0.6700

RESISTANCE: 0.6950, 0.70

BIAS: BULLISH

MOMENTUM: NON-VOLATILE