AUD/USD has been quite impulsive amid the recent bearish momentum which is currently leading the price towards 0.7000-50 support area. Yesterday the Reserve Bank of Australia expressed the dovish rhetoric in the poicy update. That pushed AUD down, enabling USD to gain strong impulsive momentum.

Recently Reserve Bank of Australia Governor Phillip Lowe stated that Australia's interest rate can move in either direction, though it is expected to move lower with a greater probability. The decision on interest rates depends on the strength of the labor market and inflation. The RBA has been keeping the interest rate unchanged at 1.50% on the grounds of relevant economic data. Besides, the board thinks that at present the domestic economy is more balanced and does not need sharp moves of interest rates. Moreover, recently a retail sales report was published with a decrease to -0.4% from the previous value of 0.5% which was expected to be at 0.0% and a trade balance report was published with an increase to 3.68B from the previous figure of 2.26B which was expected to decrease to 2.25B.

On the other hand, recently FED Chairman Jerome Powell stated that the US economy is on a sound footing that has been proved by solid ecoonmic data. Hence, the domestic economy can endure external shocks like BREXIT. According to Powell, US economy currently has low unemployment and inflation near the 2 percent target. Such conditions indicate that despite the recent government shutdown, the economy remains resilient. Moreover, citing FED's Quarles, 2019 is going to be a challenging year for the banks as it is going to examine strengths of the US banks, in other words how they withstand pressure. Additionally, today US Unemployment Claims report is going to be published which is expected to decrease to 220k from the previous figure of 253k. Besides, FOMC Member Clarida is going to speak. His speech is expected to contain the hawkish rhetoric which is bullish for USD.

Meanwhile, the US economy is healthier and more optimistic than the Australian one which is currently showing muted economic growth. This might encourage USD to gain further momentum and attract better market sentiment in the coming days.

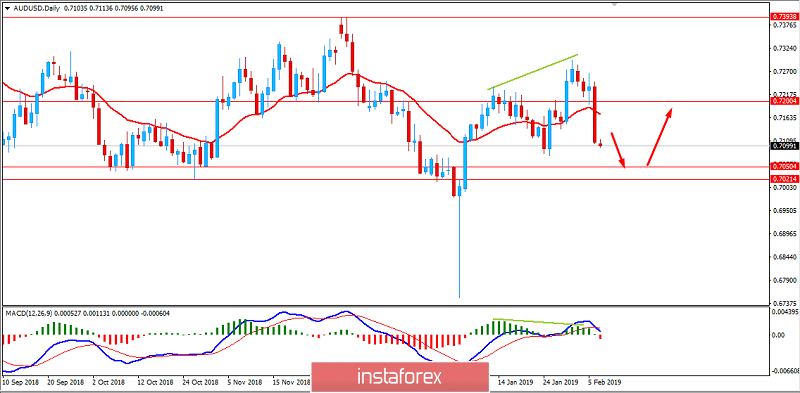

Now let us look at the technical view. The price is currently heading lower towards 0.7000-50 support area from where it may push higher with certain bullish pressure towards 0.7200 area. As the price remains below 0.7200 area with a daily close, the bearish bias is expected to continue further.

SUPPORT: 0.7000-50

RESISTANCE: 0.7200, 0.7350

BIAS: BEARISH

MOMENTUM: VOLATILE