AUD/JPY recently closed below 78.50 area amid impulsive bearish pressure, engulfing the previous corrective bullish price action. Such a price action indicates further bearish pressure in the pair.

AUD has been struggling to gain momentum against JPY recently which increased its impulsiveness when market had dovish statement from RBA Officials. Recently Reserve Bank of Australia Governor Phillip Lowe stated that Australia's interest rate can move in either direction, though it is expected to move lower with a greater probability. The decision on interest rates depends on the strength of the labor market and inflation. The RBA has been keeping the interest rate unchanged at 1.50% on the grounds of relevant economic data. Besides, the board thinks that at present the domestic economy is more balanced and does not need sharp moves of interest rates. Moreover, recently a retail sales report was published with a decrease to -0.4% from the previous value of 0.5% which was expected to be at 0.0% and a trade balance report was published with an increase to 3.68B from the previous figure of 2.26B which was expected to decrease to 2.25B.

On the JPY side, ultra-loose monetary policy by the Bank of Japan eventually managed to spur overall economic growth. As a result, JPY is winning favor with investors. Recently Japan's Prime Minister Shinzo Abe defended the BOJ's monetary policy, stating that BOJ helped to create more jobs in the economy. As the interest rates were kept low, business could borrow funds and invest easily that ultimately increased jobs in various sectors, improved employment, and led to better economic development. Additionally, today Japan's Leading Indicator report was published with a decrease to 97.9% as expected from the previous value of 99.1%. Ahead of Household Spending, Bank Lending, Average Cash Earnings and Current Account reports to be published tomorrow with optimistic forecasts, JPY can sustain momentum in the coming days.

Meanwhile, JPY is expected to hold the upper hand over AUD further, if upcoming economic reports from Japan come in as expected or better. This will empower the bears in the pair to push impulsively lower in the coming days.

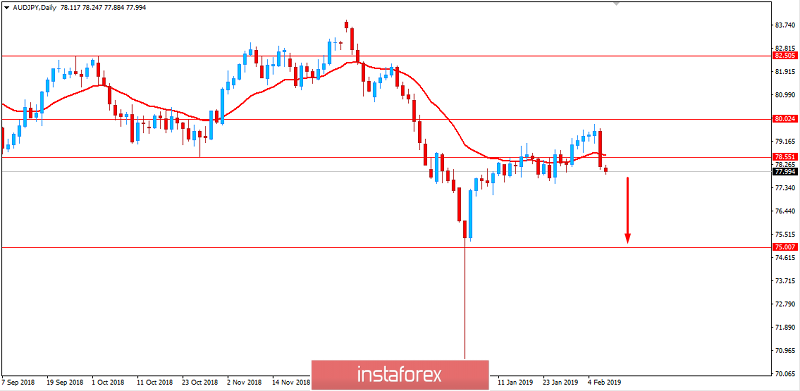

Now let us look at the technical view. The price is currently residing below 78.50 area and dynamic level of 20 EMA as well which indicates further bearish momentum. The price could sink lower towards 75.00 support area in the coming days. As the price remains below 80.00 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 75.00, 76.50

RESISTANCE: 78.50, 80.00

BIAS: BEARISH

MOMENTUM: VOLATILE