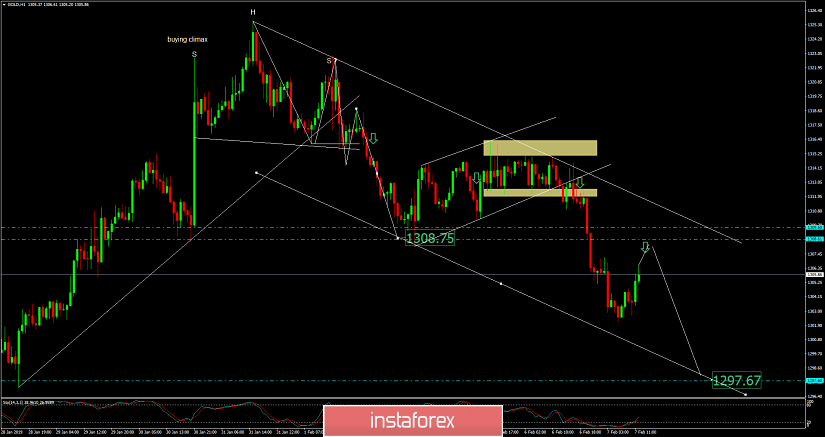

Sellers are in control in the Gold market. We found a confirmed head and shoulders pattern and absorption of the buying climax in the background, which is a strong sign of weakness. The key resistance now became previous support at the price of $1.308.00-$1.309.00. We didn't find any big sign of a price reversal, only temporary upward correction. The key short-term support still remains at $1.297.65. Besides, Gold is trading inside of the downward channel and as long as the price is trading below the upper diagonal, the trend will remain down.

R1: $1.319.65

R2: $1.324.95

R3: $1.329.96

Pivot: $1.314.65

S1: $1.309.35

S2: $1.304.30

S3: $1.299.15

Trading recommendation: We are still short on Gold from $1.311.00 and protective stop at $1.322.00. The first objective target is set at the price of $1.297.75. Anyway, if we see lack of demand and rejection from resistance at the price of $1.308.00, we would add smaller sell position.