USD/JPY has been consolidating at the edge of 110.00 area while also forming an intraday bullish Flag pattern along the way. Despite the positive economic reports from Japan last week, USD managed to sustain the bullish pressure in the pair which indicates strength of the bulls in the pair that might lead to an upward breakout in the coming days.

The FED has been quite optimistic about healthy economic ocnditions in the US. Besides, the US central bank finds monetary policy appropriate as the domestic economy has benefited from it. The inflation rate is currently at 2% as targeted by the FED and such momentum may lead to faster consumer inflation in the future. The US-China trade talks have revealed lack of progress as the US is trying to pressure China on longstanding demands. Until the deal is settled, this trade war may impact USD in several ways in the short term. Several FED officials are going to speak this week. Besides, FED Chair Jerome Powell on Tuesday is expected to provide USD with support. On the othert hand, minor inflation could assure the Fed to delay rate hikes. The consumer prices are expected to have risen 0.1% last month compared to December's fall of 0.1% but on yearly basis it is expected to be at 1.5% despite the previously calculated expectation of 1.9% which is assumed to be the affect of the partial government shutdown.

The US-China Trade War has started to affect Japan's market while the economy is hurt by global headwinds and mixed economic reports. Recently Japan's economic reports were quite positive but it failed to attract the market sentiment to inject certain bearish pressure. Japan's low interest rate policy used to work quite well earlier. However, broad-based strength of USD is going to push JPUY down. Tomorrow M2 Money Stock report is going to be published which is expected to be unchanged at 2.4% and Tertiary Industry Activity is expected to edge up to -0.1% from the previous value of -0.3%. Though the expectations are quite positive, the prints as expected or better may encourage gains on the JPY side. Otherwise, USD is expected to assert its strength.

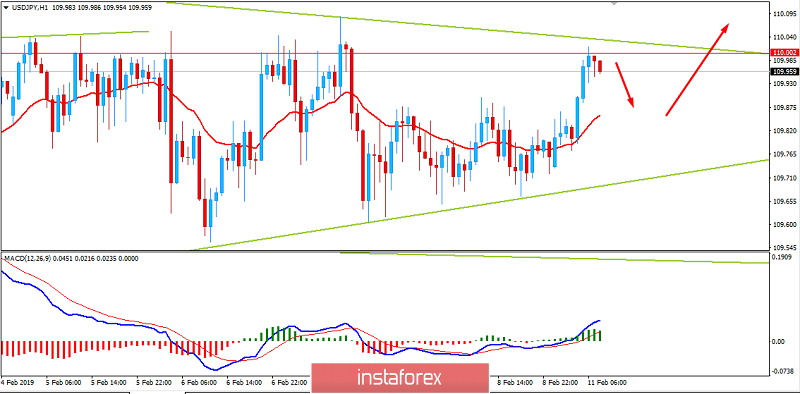

Now let us look at the technical view. The price has formed a Symmetrical Triangle while consolidating at the edge of 110.00 area which might turn into a Pennant pattern if further correction occurs in the process. The price has been pushing higher with higher swings which may lead to a breakout above 110.00 area with a daily close. A daily close below 109.50 will lead to diversion of the bias leading to strong bearish pressure with a target towards 108.50 support area.

SUPPORT: 108.50, 109.50

RESISTANCE: 110.00-50, 111.50, 112.00

BIAS: BULLISH

MOMENTUM: VOLATILE