USD has been badly hurt by dismal retail sales despite hawkish statements from some FED officials. The FED's optimism about the healthy domestic economy encouraged USD rally, thus taking the shine off CHF.

Recently JP Morgan cut its estimate for the US economic growth. Experts do not assume the FED to raise rates as the same fast pace as in 2018. The median forecast suggests at least 2 rate hikes this year. However, according to JP Morgan the US central bank is likely to raise rates only once to 3% and by 2020 the maximum rate will be at 3.5%. According to the market research note "the more dovish path should allow the economy to grow faster than previously projected". FED's Governor Brainard recently stated that she is quite positive with the Balance Sheet normalization which will encourage further economic growth.

As for the US-China trade talks, Trump's administration is indecisive yet which confused the market sentiment about progress in the trade deal. Today US Empire State Manufacturing Index report is going to be published which is expected to increase to 7.1 from the previous figure of 3.9, Import Prices could have increased to -0.1% from the previous value of -1.0%, Capacity Utilization Rate is expected to show a slight increase to 78.8% from the previous value of 78.7%, and Industrial Production is expected to decrease to 0.1% from the previous value of 0.3%.

On the other hand, recently Switzerland's CPI report was published unchanged at -0.3% which was expected to tick up to -0.2% and PPI dropped to -0.7% from the previous value of -0.6% which was expected to increase to -0.4%. The economic calendar today lacks economic data from Switzerland. Despite mixed economic data, CHF could gain momentum against USD. It indicates that the market sentiment is currently against USD because the US Fed could not raise interest rates this year and investors lack confidence about a beneficial trade deal between the US and China. To make things worse, dismal retail sales caused USD weakness. Until the US provides solid economic data, CHF is expected to keep momentum in the coming days.

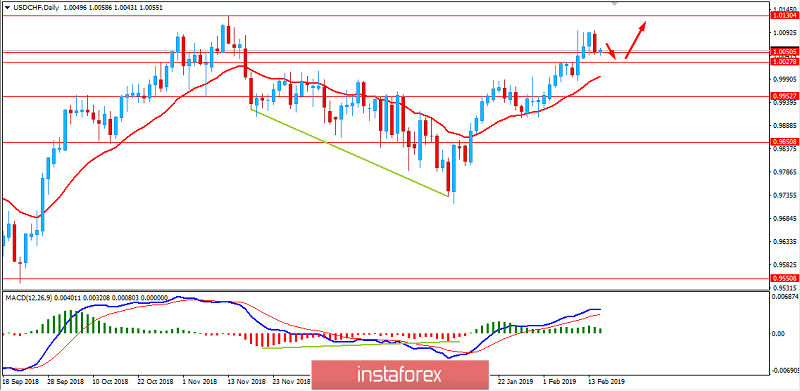

Now let us look at the technical view. USD has been dominating in the currency pair which recently got counter trend pressure from CHF. As the trend is bullish, despite the recent bearish pressure the pair is expected to regain momentum with the view of trading higher as the bullish trend is non-volatile. As the price remains above 1.00 area with a daily close, the bullish pressure is expected to continue further.

SUPPORT: 0.9850, 0.9950, 1.00

RESISTANCE: 1.0130, 1.0200

BIAS: BULLISH

MOMENTUM: NON-VOLATILE