GBP managed to push higher against JPY in a non-volatile impulsive manner after bouncing off the 141.00 with a daily close. As BREXIT term are coming forward, the Deal and No-Deal BREXIT discussion is going high as policymakers are discussing advantages and disadvantages of each scenario.

Recently Goldman Sachs cut the No-Deal BREXIT chance from 15% to 10% as they think BREXIT may be delayed for a few months in the context of ongoing standoff between UK policymakers. Theresa May won a two-week reprieve on Wednesday from British Lawmakers aiming to block a no-deal BREXIT. Additionally, the Bank of England has investigated for several years whether it can glean anything about the economic outlook. As the Bank of England is quite certain about an economic downturn after a no-deal BREXIT, so a delay in the BREXIT term might help the economy to adapt gradually to new conditions.

Today UK Manufacturing PMI report is going to be published which is expected to decrease to 52.0 from the previous figure of 52.8 and Net Lending to Individuals is also expected to decrease to 4.7B from the previous figure of 4.8B. Moreover, M4 Money Supply is expected to decrease to 0.3% from the previous value of 0.4% and Mortgage Approvals is also expected to decrease to 63k from the previous figure of 64k.

On the other hand, Japan accelerated capital expenditure from October to December that indicates economic growth. However, economists warn that waning global trade will hurt the domestic growth at least for the first 6 months of this year. JPY has been struggling amid downbeat economic reports like Retail Sales decreasing to 0.6% from 1.3% which was expected to increase to 1.4% and Housing Starts decreasing to 1.1% from 2.1% which was expected to surge to 10.4%.

Today Tokyo Core CPI report was published unchanged at 1.1% which was expected to decrease to 1.0%, Unemployment Rate increased to 2.5% which was expected to be unchanged at 2.4%, Capital Spending increased to 5.7% which was expected to be unchanged at 4.5%, and Final Manufacturing PMI also increased to 48.9 from the previous figure of 48.5. Additionally, JPY Consumer Confidence report is yet to be published which is expected to decrease to 41.6 from the previous figure of 41.9.

Meanwhile, GBP is pessimistic currently ahead of unsettled BREXIT decision. So, GBP could extend weakness against JPY which has been performing quite well today supported by the economic reports. On the whole, JPY is going to hold the upper hand over GBP.

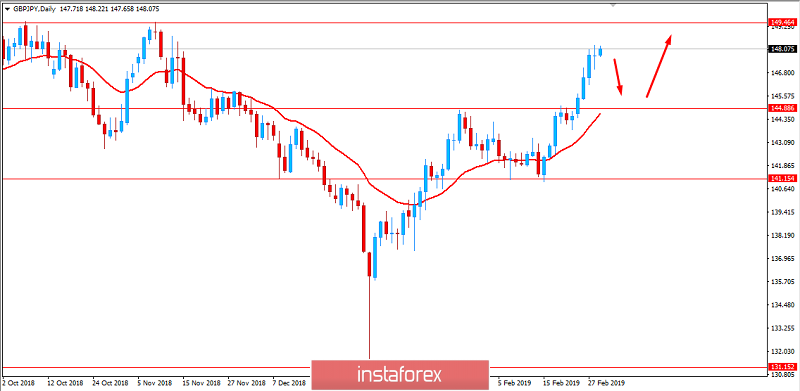

Now let us look at the technical view. The price is currently trading quite far from the Mean average which is expected to attract the price towards the mean leading the price down towards 145.00 area in the coming days. After a retracement towards 145.00 area, the bullish pressure is expected to follow the trend with a target towards 149.50-150.00 area.