GBP has been the dominant currency in the pair. JPY is struggling for gains on the back of Bank of Japan's ultra-loose monetary policy and indecisive rhetoric.

Bank of Japan's board member Harada recently stated that Japan's regulator needs to step up quicker if they want to avoid risk to the economy trying to hit the inflation target of 2%. According to Harada, the BOJ is looking at one factor rather than the whole picture which might affect the economy on a large scale. The BOJ is currently focused on the inflation target. How the domestic economy is performing is the thing of secondary importance to the Bank of Japan right now. Japan is facing a growing risk like muted demand in China due to trade jitters with the US, simmering trade tensions, and volatile stock moves along with weak private consumption. These factors hampered the overall growth of the domestic economy. Today Japan's Leading Indicator report is going to be published which is expected to decrease to 96.2% from the previous value of 97.5%. If it performs worse than expected, JPY is going to extend weakness.

On the GBP side, the stronger currency in the pair is expected to lose momentum ahead of GBP in the process as BREXIT process is still quite indecisive. The Bank of England is closely monitoring Brexit developments before it ventures into a change in interest rates. Besides, the BoE needs to update inflation and economic growth forecasts. According to rate-setter Michael Saunders, inflation is well-behaved and economic growth is modest, but a no-deal BREXIT is sure to affect the growth in a significant way. Amid the current economic conditions, if the UK Prime Minister manages to nail down a divorce deal with the EU, there are certain things which will bring in immediate changes, including borrowing costs. Great Britain is expected to leave the EU on March 29th. However, the question is till open whether the departure will take place with or without a deal. Besides, there is a growing likelihood that Brexit could take place with a delay. The UK is expected to scrap 80-90% of tariffs on imported goods if it leaves the EU with a deal, excluding certain sectors like cars, meats, and textiles.

GBP has been the stronger currency in the pair recently despite downbeat economic reports published recently. Today Halifax HPI report was published with an increase to 0.1% from the previous negative value of -2.9%. MPC Member Tenreyro is going to speak about the key interest rate and future monetary policies. The speech is expected to be indecisive and neutral ahead of BREXIT this month.

Meanwhile, GBP could make correctional gains before it loses momentum ahead of the looming BREXIT. Though JPY has been struggling to gain momentum over GBP, any downbeat data from the UK will lead to a drastic fall of the British currency where even the weak JPY may also gain certain pressure.

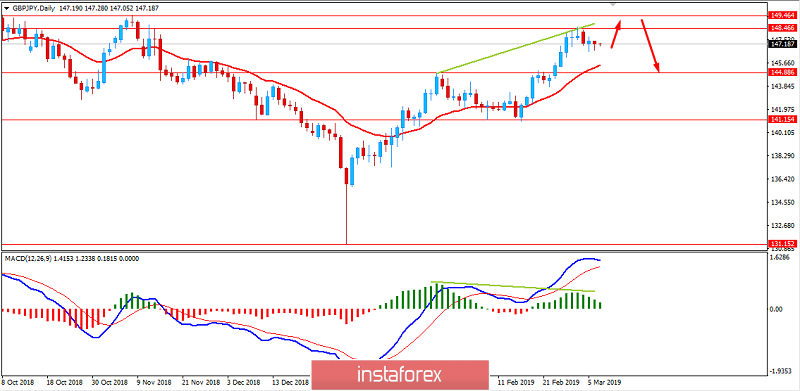

Now let us look at the technical view. The price is currently heading towards 149.50-150.00 resistance area while forming a Bearish Regular Divergence. Though the Bearish Divergence is still underway, a rejection with a daily close off the 149.50-150.00 area could indicate further bearish pressure in the coming days. As the price remains below 150.00 area with a daily close, the chance of certain bearish momentum is expected.