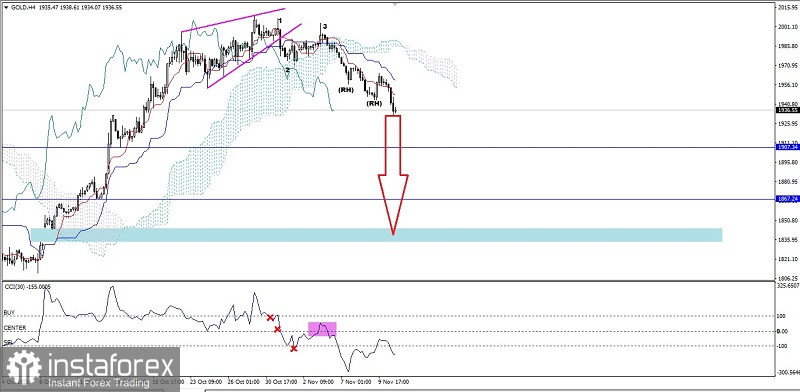

If we look at the Gold commodity asset, we can see several interesting facts, namely that the price movement after successfully breaks below the Rising Wedge pattern and then forming a Bearish 123 pattern which was followed by a bearish Ross Hook and followed by Tenkan Sen & Kinjun Sen Death Cross under Kumo along with Chikou Span which is below Kumo and its price movement is also confirmed by the CCI indicator which has managed to breaks below three important levels. So that based on these facts, we know that the condition of Gold Commodity assets is currently in a fairly significant weakening condition so that in the near future it has the potential to fall down to level 1937,34 as the main target and if volatility and momentum also support it then level 1867,24 will be the next target to be aimed at but if on its way to these target levels suddenly there is a strengthening correction upwards until it breaks above level 1970,57 then all the weakening scenario previously described will become invalid and cancel itself.

(Disclaimer)