GBP/USD has been trading with higher volatility making corrections. As a result, the pair managed to push below 1.3100 with a daily close. The market sentiment remains indecisive as the UK has to accept one of several Brexit options. No wonder GBP is expected to lose ground in the short term.

The UK is facing the following options: a long extension of the Brexit deadline, no-deal hard Brexit, or staying in the EU. Such uncertainty puts investors on edge. Remarkably, despite nervousness among market participants last week, GBP managed to gain certain momentum over USD which pushed the price higher towards 1.3350 area. This week the UK is due to release GDP data which is expected to ease a pace of growth to 0.2% from the previous value of 0.5%. Besides, UK Manufacturing Production is also expected to decrease to 0.2% from the previous value of 0.8%. Such economic reports are certainly bearish for GBP. As a result, USD could take advatnage of the weak UK data to put pressure on GBP. Additionally, British PM Theresa May requested the EU for a Brexit extension until April 12, 2019. In this context, GBP-related currency pairs could trade with extreme volatility and spikes on the GBP side this week.

On the USD side, USD gains are capped by the US-China trade conflict and Fed's dovish rhetoric which might lead even to a rate cut next year. Recently US Average Hourly Earnings report revealed a decrease to 0.1% from the previous value of 0.4% which was expected to be at 0.3% and Unemployment rate remained unchanged as expected at 3.8%. On the plus side, the non-narm employment change was better than expected with a surge to 196k from the previous minor growth of 33k. The fresh reading was much stronger than consensus of 172k new jobs. Though the Employment Change was significantly better, an uptick in average hourly earnings indicates unstable conditions of the US labor market.

This week FOMC Meeting Minutes along with Federal Budget Balance report are going to be published on Wednesday. Federal Budget Balance is expected to contract to -194.7B from the previous figure of -234.0B. Moreover, on Thursday US PPI report is going to be published with factory inflation increasing to 0.3% from the previous value of 0.1%. FOMC Members Clarida and Bullard are due to speak about current and future monetary policy and short-term interest rate decisions.

Meanwhile, this week GBP/USD is expected to be quite volatile and corrective. Analysts do not rule out upward momentum above 1.31. GBP could gain ground for a while. However, any positive reading in US data will invite bears to retain momentum firmly.

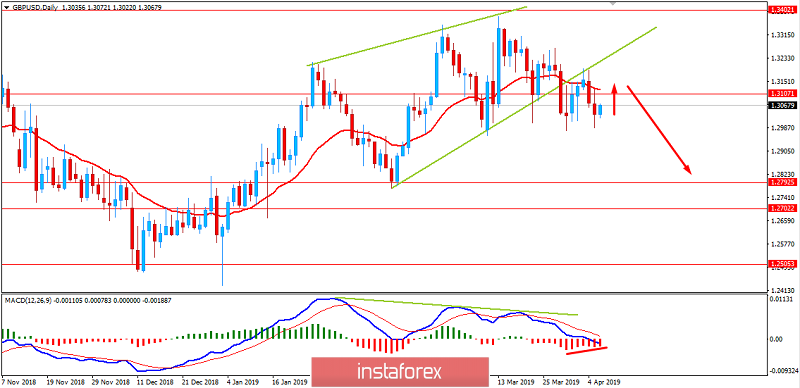

Now let us look at the technical view. The price is trading below 1.31 now. The pair is expected to climb higher towards 1.31-1.3200 area in the coming days before retracing lower towards 1.30 and later towards 1.2500 area in the future. As the price remains below 1.35 with a daily close, the bearish bias is expected to continue further.