The USD/CHF pair had been moving downwards since the recent rebound from the 1.01 resistance area with a daily close. The US dollar weakened amid the trade tensions and disappointing economic reports.

The US preliminary GDP data met the expectations and showed a decrease to 3.1% from the previous value of 3.2%, while the preliminary GDP Price Index also declined to 0.8%, while it was anticipated to remain unchanged at 0.9%. Earlier, Fed's vice chair Randal Quarles stated that the Central Bank's longstanding view is that macroprudential policies, not interest rates, are the key banking tools best suited to addressing risks to financial stability. While overall financial stability risks are currently not elevated, higher-than-usual business debt built up during the current near-record economic expansion could set the stage for worse outcomes in a future downturn. Quarles did not speak to his current outlook for the economy or interest rate policy in his prepared remarks, though their thrust suggested he is not a supporter of the rate cut in coming months that traders of short-term interest rate futures are currently betting on.

On the trade war issue, President Donald Trump said that the United States was doing well in trade talks with China and that Beijing wanted to make a deal with Washington. Trade tensions between Washington and Beijing escalated sharply earlier this month after the Trump administration accused China of having "reneged" on its previous promises to make structural changes to its economic practices. Washington later imposed additional tariffs of up to 25% on $200 billion of Chinese goods, prompting Beijing to retaliate.

Today's US Personal Spending report is going to indicate a decrease to 0.2% from the previous value of 0.9%, while the Personal Income is expected to increase to 0.3% from the previous value of 0.1%, and the Core PCE Price Index is forecast to rise to 0.2% from the previous value of 0.0%.

On the CHF side, Switzerland's Q1 GDP is going to be released this week and will likely show the country's economy began 2019 on a soft note. It came to a standstill during the second half of 2018 with almost no growth during that period. The consumer spending grew barely, while private investment spending contracted in both Q3 and Q4. For Q1-2019, the consensus for the GDP is to rise to 0.3% quarter-over-quarter, while the 0.2% gain was forecast for Q4. Given the modest growth and little inflation, the SNB is expected to maintain its expansionary monetary policy for some time. In particular, the central bank will likely keep its interest rate at -0.75% for a longer period, while it has also said it will intervene in foreign exchange markets as needed to prevent extreme currency strength.

As for the current scenario, the franc is attracting market sentiment and expected to strengthen against the greenback as the upcoming weak economic reports from the United States are to soften the US dollar.

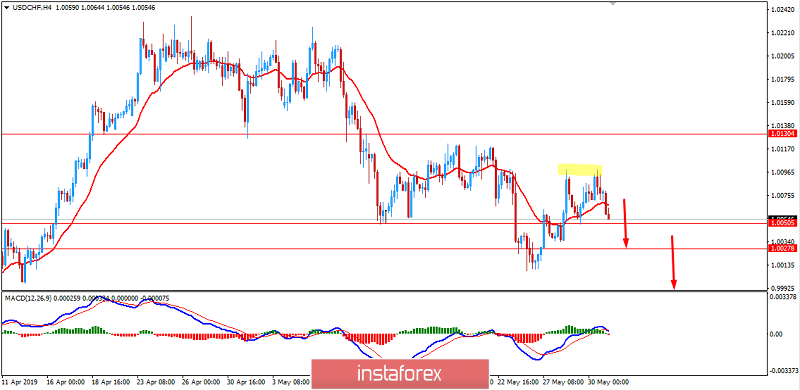

Now, let us look at the technical view. The price is currently moving lower towards the 1.00 support area after forming a Double Top chart pattern which increased bearish pressure. As for the preceding trend, sellers are quite strong and likely to push the price lower towards the 0.9850 support area in the coming days. As far as the price remains below the 1.01 area with a daily close, the bearish bias is expected to continue.