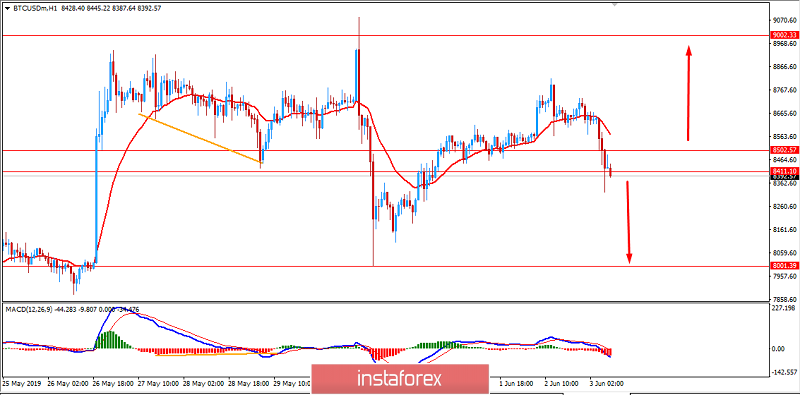

Bitcoin managed to regain certain momentum after the strong drop towards $8,000 area after rejecting off the $9,000 area with a daily close. Currently, BTC is pushing strongly lower again for a probable double bottom formation according to the analysis of the price action.

The bearish divergences between Bitcoin's price have been spotted. Besides, there are the Relative Strength Index and the Moving Average Convergence Divergence (MACD). In other words, as BTC has moved higher over the past two weeks, these indicators have trended lower. This is important, as bullish divergences (the opposite of bearish divergences) preceded several crypto market rallies in a similar manner over recent trading sessions.

Although Bitcoin faced downward pressure earlier this week, it has since been able to recover. BTC price appears to extend the upward momentum which it has caught over a few recent weeks. It now appears that Bitcoin's next key level of resistance remains in the $8,800 region. So, a break above this level could lead to an influx of buying pressure that sends the price surging to fresh year-to-date highs.

Meanwhile, Bitcoin bulls seemed to be still optimistic with the price pushing higher with a target towards $10,000 despite the current increasing bearish momentum. Though there are certain resistance levels ahead like $8,800, $9,000, $9,250, and $9,500 ahead of price reaching towards the milestone price region of $10,000 area, the bulls are expected to rule out the bears again despite the current consolidation and volatility taken into the account.

SUPPORT: 8,000, 8,400

RESISTANCE: 8,800, 9,000, 9,250, 9,500

BIAS: BULLISH

MOMENTUM: VOLATILE