GBP managed to gain momentum over USD recently which lead the price to reside at about 1.2700 with a daily close. Despite weak economic reports, gains on the GBP side indicate that USD is losing momentum.

The UK posted a larger-than-expected budget deficit last month as government spending rose. It reminds the market that the next finance minister may have limited options to support any Brexit impact on the economy. As for the National Statistics, the budget deficit widened to 5.115 billion pounds. For the first two months of the 2019/20 financial year, the deficit was 18% larger than a year earlier at just under 12 billion pounds. An increase in government borrowing this year after a steady fall in the size of the deficit from around 10% of economic output in 2010 to just above 1% last year.

Recently UK released a retail sales data with contraction to -0.5% as expected from the previous value of -0.1%. Besides, the Bank of England kept the key interest rate unchanged at 0.75% as expected. The UK's central bank put on hold the volume of the asset prchase facility and monetary policy. GBP lost momentum against USD recently. Today the UK Public Sector Net Borrowing report was published with a decrease to 4.5B from the previous figure of 6.2B which failed to meet the expected decline to 3.3B. The worse-than-expected reading affected sustainable GBP gains.

On the other hand, the US economy is struggling amid the trade wars and the Fed's rhetoric in favor of a rate cut. Poor economic data from the US boosted GBP gains recently. Despite the obstacles, today due to tepid UK economic report, USD managed to put pressure on GBP. According to the US Chief Economist, the Fed may leave the interest rate unchanged throughout 2019. On the other hand, the market is betting on the rate cut in the coming months. US President Donald Trump recently targeted Federal Reserve Chairman Jerome Powell. The US leader advocates for cutting interest rates. A day after at the policy meeting central bankers signaled they would likely do so later this year to prop up economic growth and boost sluggish inflation.

Today US Flash Manufacturing PMI report is going to be published which is expected to be unchanged at 50.5 and Flash Services PMI is expected to decrease to 51.0 from the previous figure of 50.9. Additionally, Existing Home Sales report is expected to increase to 5.29M from the previous figure of 5.19M.

To sum it up, the downbeat economic reports from the UK already put pressure on GBP gains over USD.

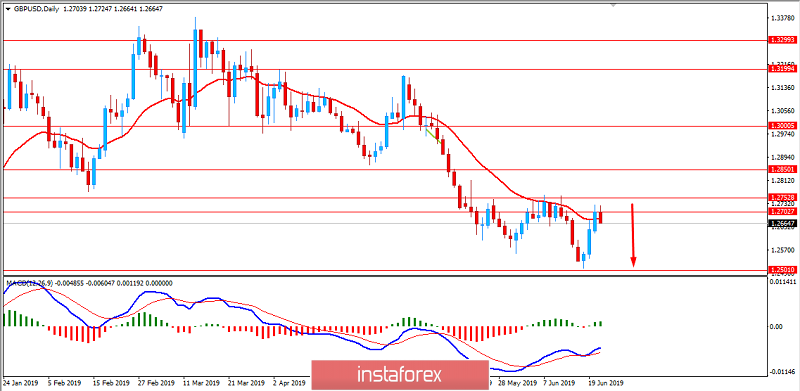

Now let us look at the technical view. The price is currently going lower quite impulsively after rejecting off the 1.2700 area with a daily close which is expected to result in further bearish pressure with a target towards 1.2500 again in the coming days. As the price remains below 1.2750 area with a daily close, further bearish momentum is expected in this pair.