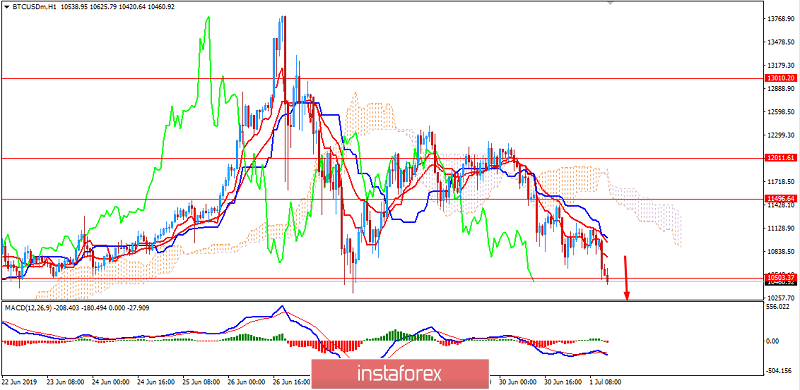

Bitcoin gained bearish momentum which pushed the price to the level below $10,500. The price may decline towards the psychological area of $10,000 in the short term.

The Bitcoin market has been stronger than ever, but its price is following the bearish bias inside the long-awaited correction. At the weekend, the market siggested the scenario that the bulls could push the price higher. However, those thoughts have been ditched today as markets continue to dump. The BTC has shed over 10% in last 24 hours as the crypto markets shrank $25 billion recently. The weekly closing candle also indicates that further losses could be imminent as indecision between bulls and bears could signal a short-term trend reversal.

Bitcoin is currently trading in range between $10,000 and $14,000 over the next couple of weeks. The biggest targets of $20,000 and $25,000 may be reached quite faster than previous times. A little sideways action may not be a bad thing for Bitcoin. It would allow more accumulation and may give some of the altcoins time to wake from their long hibernation.

To sum it up, most analysts share the viewpoint that Bitcoin is making a correctional decline which might lead to further indecision. Though the price is currently trading above $10,000 under a strong bullish bias market sentiment, the ongoing bearish pressure is now stronger in comparison to previous retracements. As the price remains above $10,000, it is expected to bounce back towards $14,000 and later towards $15,000 and then $20,000 or so. Nevertheless, before pushing higher under such impulsive pressure, certain correction and volatility is imminent for BTC in the nearest days.

SUPPORT: 9,800, 10,000

RESISTANCE: 10,500, 11,000, 12,000

BIAS: BULLISH

MOMENTUM: VOLATILE