EUR/GBP has been non-volatile amid the recent bullish momentum which pushed the price roughly to 0.90 before moving lower under strong bearish pressure. EUR is more confident because the eurozone's economy is in a shape shape than the British one. This enables EUR to sustain gains quite well, but upcoming volatility may trigger a correction along the way.

The ECB is trying all measures to spur consumer inflation as well as economic growth despite certain budget deficit and global trade tensions. According to the European monetary authorities, major EU banks face a collective shortfall of 135 billion euros ($153 billion) to fully comply with global capital requirements by 2027. In other words, they need to raise their capital by at least 24.4%. The European Central Bank policymakers aren't ready yet to rush into additional monetary stimulus at a meeting this month. Instead they opt to wait for more data on the economy. Most analysts share the viewpont that the ECB may announce a change in monetary policy in July based on the inflation outlook, inflation expectations, and downside risks to growth.

Today the eurozone's retail sales report is going to be published which is expected to rebound to 0.4% from the previous value of -0.4%. On Friday, the economic calendar contains German Factory Orders and French Trade Balance report. Investors have mixed expectations with a mostly negative tone. This may dent market sentiment on EUR inthe coming days.

On the UK side, recently Bank of England Governor Mark Carney said a global trade war and a no-deal Brexit were growing possibilities but not certainties. So, the central bank focuses on the medium-term inflation outlook to guide its stance on interest rates. According to Carney, the underlying growth in Britain has been running below its potential and was heavily reliant on the resilience of household spending. The UK is still trying to get into a deal with the EU before the BREXIT decision is taken. Moreover, Britain's economy appears to have shrunk for the first time since late 2012 between April and June as worries about Brexit were compounded by global trade tensions.

The UK GDP last contracted from one quarter to another in the final three months of 2012, according to official data. The last time GDP fell for two or more quarters in a row, the widely accepted definition of a recession, was in 2008-2009 during the global financial crisis. Under current economic conditions, a rate cut in the UK is likely to soften the upcoming pressure on the economy. This quarter, GBP is expected to sustain and extend its gains while EUR may struggle to regain.

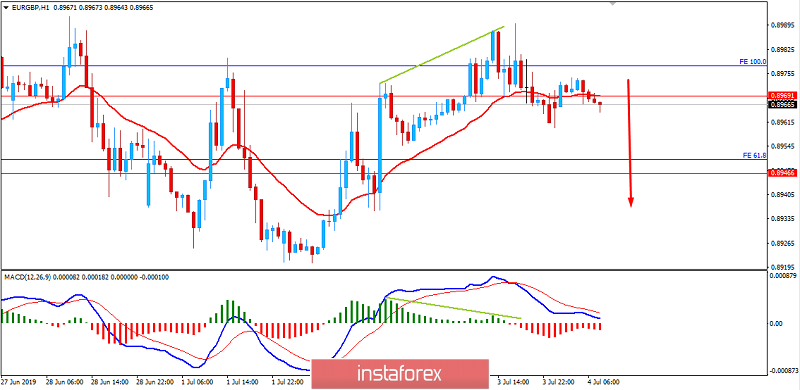

Now let us look at the technical view. The price has recently formed a Bearish Divergence from Fibonacci Expansion level of 100 from where the price declined with certain spikes and impulsive bearish pressure. The price is currently expected to drop after 0.8950 is broken below. Thus, the bearish momentum is expected to push the price lower towards 0.8850 and later towards 0.8750 area in the coming days.