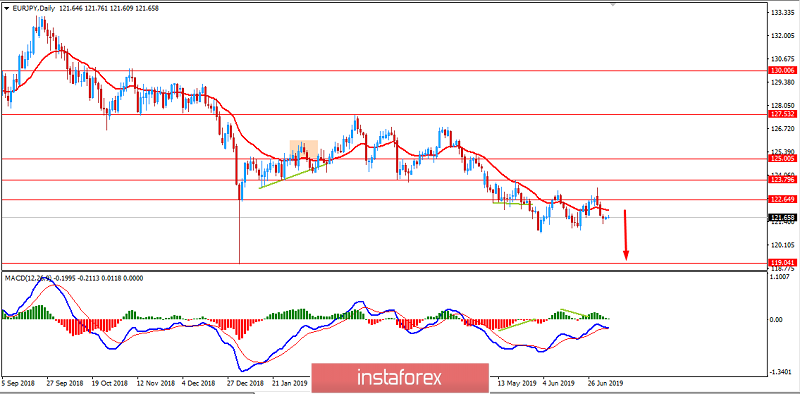

EUR/JPY has gained bearish momentum which sustained quite well while the price was holding firmly below 122.50 with a daily close.

Japan's household spending today hit a 4-year high that helped JPY to sustain further momentum over EUR. The percentage of Japanese households anticipating inflation to accelerate in the nearest 12 months surpassed expectations greatly. The Bank of Japan's survey on people's livelihood showed the percentage of households who expect prices to rise a year from now was 80.5% in July, the highest level since September 2015. Today, BOJ's Deputy Governor Amamiya stated that negative rates on digital currencies will result in holding cash instead to avoid being charged for holding digital currencies which can make an inverse effect on further economic development. He also stated that Japan's economy remains on track to achieve the central bank's 2% goal as robust capital expenditure offsets some of the weaknesses in exports and output.

The trade dispute between the US and China has hurts global demand and clouded Japan's economic outlook. Experts predict that the BOJ could ease monetary policy as early as at this month's rate review. Despite certain challenges, the economy expanded by an annualized 2.1% in the first quarter. Nevertheless, experts warn that Japan's economic growth may skid in the coming months as the trade jitters between the US and China hurt exports. A scheduled sales tax hike in October may also undermine private consumption.

On the other hand, the eurozone is facing economic troubles that has been confirmed by the latest mixed economic reports. It is the main reason for recent EUR weakness. The ECB is trying all measures to spur headline inflation as well as economic growth despite budget deficit and global trade tensions. The eurozone bank sector's profitability is expected to dip this year before recovering over the following two years. The combined return on equity for banks supervised by the ECB may dip to 5.4% this year from 6.7% a year and then rise to 7.3% and 7.9% in the subsequent years. As the euro area faces fundamental problems, its banks need more capital along with joint deposit insurance and dedicated government funds to prevent panic when the next crisis comes.

Now let us look at the technical view. The price is currently going lower after a correctional climb. Bearish Divergence is expected to push the price lower to 119.00-120.00 in the coming days. If the price stays firmly below the dynamic level of 20 EMA amid impulsive bearish momentum, this will indicate a move lower.