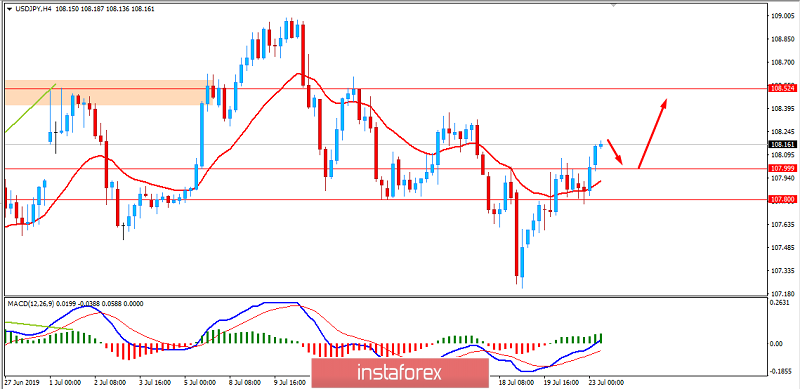

The USD/JPY pair managed to regain bullish momentum breaking above 108.00 area.

Japan's economy has been affected by the US-China trade war which mainly hampered the exports which is the most reliant source of income for Japan. China's slowing economy, its trade war with the United States and spreading protectionism have led to a seventh straight monthly fall in Japan's exports and weakened factory output, threatening to derail the world's third-largest economy. Uncertainty for the Japanese economy remains over the global economic outlook such as trade frictions and Britain's exit from the European Union. Recently, Bank of Japan's Governor Haruhiko Kuroda stated that BOJ will pay close attention to the impact heightening global uncertainties and jittery market moves could have on Japan's economy in guiding monetary policy and BOJ do not need to be too pessimistic about their ability to stimulate the economy with additional monetary easing, even if faced with a substantial decline in the natural rate of interest.

Today BOJ Core CPI report has been released published. It indicated a decrease to 0.6% from the previous value of 0.7% as expected. Amid such news, the US dollar lifted up locating above 108.00. On Friday, Tokyo Core CPI report will be released. The reading is likely to drop to 0.8% from the previous value of 0.9%.

US President Trump has been pressurizing the Fed for lowering the interest rate which is most probable on the Central Bank's next meeting but yet it is not fully confirmed. A 50-basis point cut in interest rate is most expected at the June meeting if the Fed agrees and acts on the government pressures. However, Fed's officials stated that they will not bow to political pressure, but several officials have said growing risks to the economy warrant a rate cut. Policymakers have cited concerns that a global economic slowdown and international trade conflicts could derail economic growth in the United States, despite recent signals of strength from economic data.

The US Durable Goods Orders report is likely to show an increase to 0.8% from the previous value of -1.3% and Core Durable Goods a decrease to 0.2% from the previous value of 0.4%. Moreover, on Friday, the US Advance GDP report is also going to be published. The figure is expected to sink to 1.8% from the previous value of 3.1% while the Advance GDP Price Index is expected to rise to 4.0% from the previous value of 0.9%.

Thus, the US dollar has strengthened against the yen. Nevertheless, it may be quite volatile ahead of the Fed's meeting.

Now let us look at the technical view. The price managed to reside above 108.00 area and above the dynamic level of 20 EMA. It indicates a mean reversion towards 108.00. The price is likely to reach the target area of 110.00. As the price remains above 107.80-108.00 area with a daily close, the bullish bias is expected to continue.