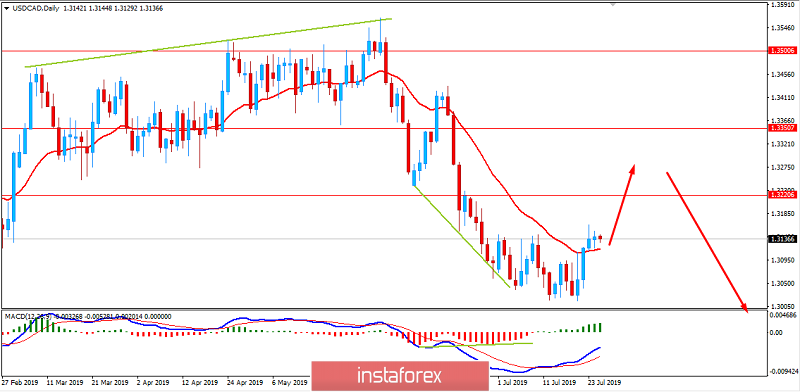

USD/CAD has been quite corrective and volatile recently, bouncing off the 1.30 support area with a daily close. The US dollar is expected to weaken ahead of a probable rate cut this month, so the trend in USD/CAD may turn from bullish to bearish.

A quarter-point rate cut by the Federal Reserve in July is almost a done deal as economic risks and the ongoing US-China trade war has been denting the economic growth lately. Expectations in the July 16-24 poll for the first rate cut in more than a decade have firmed this month after several Fed members had explicitly hinted policy easing in the nearest future. As a result, the US stocks soared to new record highs. Over 95% of 111 economists now predict a 25-point cut at the July 30-31 meeting. While some US economic indicators have dipped, the unemployment rate plunged to the lowest level in 50 years and the Wall Street is at a record high. Fed rate expectations have taken a U-turn this year, going from a steady tightening path to a series of cuts. The US economy has probably lost momentum last quarter and is now forecasted to have expanded at an annualized pace of 1.8% in the April-June period, down from 3.1% reported for the first quarter.

Today the US Durable Goods Orders report is going to be published which is expected to increase to 0.8% from the previous negative value of -1.3% while the Core Durable Goods Orders is expected to decrease to 0.2% from the previous value of 0.4%. Moreover, Goods Trade Balance is expected to rise to -72.4B from the previous figure of -74.5B. At the same time, the Prelim Wholesale Inventories report is expected to advance to 0.5% from the previous value of 0.4%.

On the other hand, oil prices remain under pressure amid low growth expectations. The Bank of Canada could be pulled into action sooner rather than later if economic indicators don't improve. Currently, the BOC enjoys some breathing room, but that could quickly evaporate if weaker data starts coming in. The Fed's forward guidance may largely influence the broader outlook for USD/CAD especially as the Bank of Canada sticks to the sidelines. USD/CAD is at a risk of exhibiting more bearish behavior if the FOMC shows a greater willingness to implement lower interest rates throughout the second half of 2019.

This week, the Canadian wholesale sales decreased to -1.8% from the previous value of 1.6% which was expected to be at 0.8%. The worse economic result weakened the Canadian dollar and helped the US dollar to regain certain momentum after being dominated since the price rejected off the 1.3500 area with a daily close.

Now let us look at the technical view. The price is heading higher towards 1.3200 area with a daily close which is expected to continue pushing lower if any bearish pressure or rejection is observed along the way. As the price remains below 1.3200 area with a daily close, the bearish bias is expected to continue which is expected to push lower towards 1.30 area in the future.