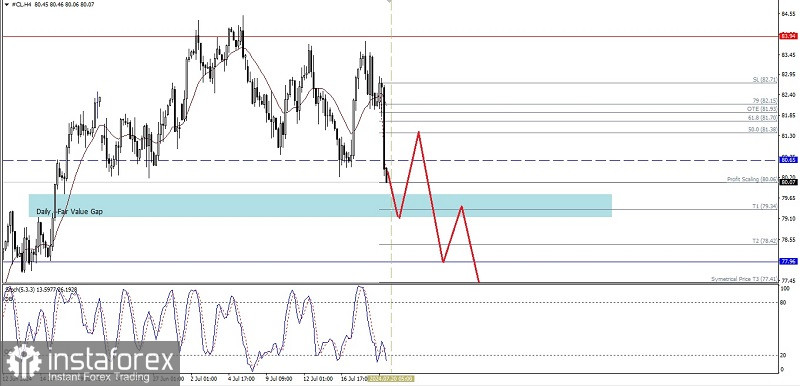

Currently on the 4 hour chart the Crude Oil commodity asset appears to be moving in a Sideways / Ranging condition where the movement is moving around the level. This is confirmed by the movement of the Moving Average which moves between the bodies of the candlesticks repeatedly but because previously the Stochastic Oscillator indicator was above the level Overbought and currently preparing to fall below the Oversold level, in the near future it has the potential to test down below the 80.06 level so that if this level is successfully broken downwards then #CL has the potential to continue its weakening to level 79.34 and if momentum and volatility support then the 77.96 level will becomes the next target to be aimed at, but all of these weakening scenarios can become invalid and cancel themselves if on their way to these targets suddenly #CL is corrected upwards until it breaks above the 82.71 level.

(Disclaimer)