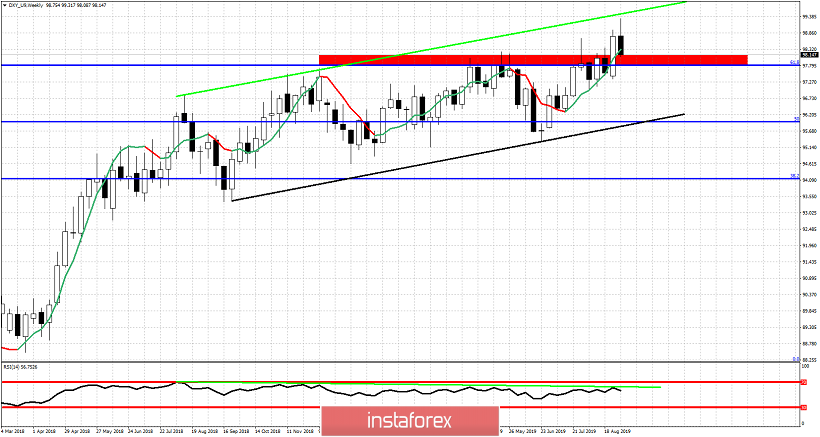

In a previous post we noted that a break above 98.20 would lead the Dollar index towards 99.15 for a final new higher high and a new bearish divergence. Price reversed exactly as we expected and now challenges major support.

Red rectangle - previous resistance now support

The Dollar index made a new weekly high but the weekly candle looks like a reversal is on the making. Combined with a bearish weekly divergence bulls need to be very cautious. My key support is at the previous resistance at 98 area. Price is back testing this area which is now support. Holding or bouncing above it is a bullish sign. Breaking below the red rectangle area will open the way for a move much lower.