Overview:

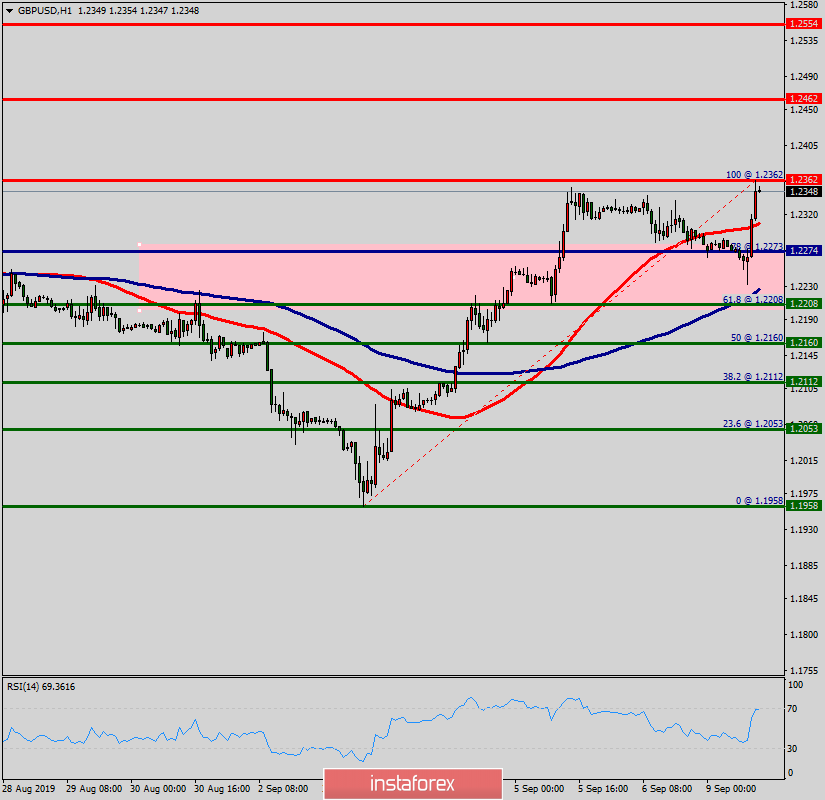

Pivot point: 1.2274.

The GBP/USD pair can still form an ascending impulse, it continues to rise upwards. The major support is seen at 1.2208 which coincides with the ratio of 61.8% Fibonacci.

Consequently, the bullish trend is still expected for the upcoming days as long as the price is above 1.2208. The bias remains bullish in the nearest term testing 1.2362 and higher.

The bullish outlook remains the same, as long as the 100 EMA is pointing to the upside. Additionally, the RSI is still calling for a strong bullish market

If the trend is buoyant, then the currency pair strength will be defined as following: GBP is in an uptrend and USD is in a downtrend.

Long positions are recommended at the spot of 1.2274 (pivot) with a first target at 1.2362.

If the trend breaks the resistance level of 1.2362, the pair is likely to move upwards continuing the development of bulish trend to the level 0.6460 in order to test the daily resistance 2 (horizontal red line).

However, stop loss is to be placed below the level of 1.2208.