Gold price started the week higher than the previous week close but ended with a lower close. Bulls have failed to hold above the $1,500 pivot level and price remains inside the bearish channel showing more signs of weakness.

Green lines - bearish channel

Gold price is still inside the weekly bearish channel while the RSI is turning lower from overbought levels breaking below 70. This implies more downside should be expected. Our key resistance level of $1,525-35 remains intact and as long as price respects this resistance we remain bearish and consider each bounce as a selling opportunity. Our expectations remain bearish targeting a move below $1,460.

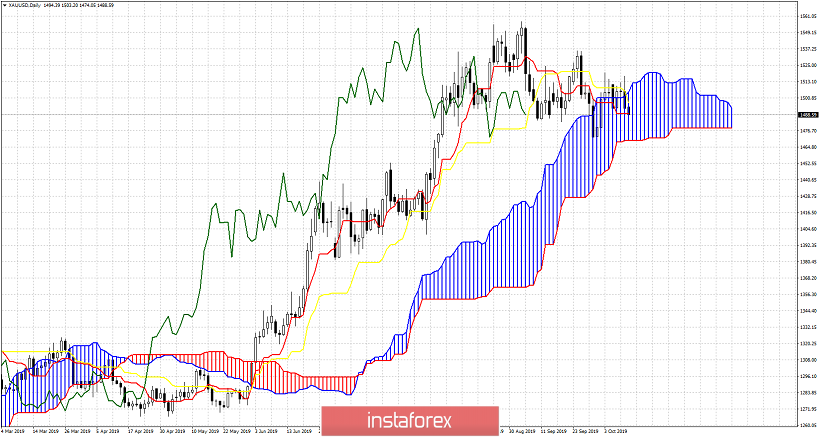

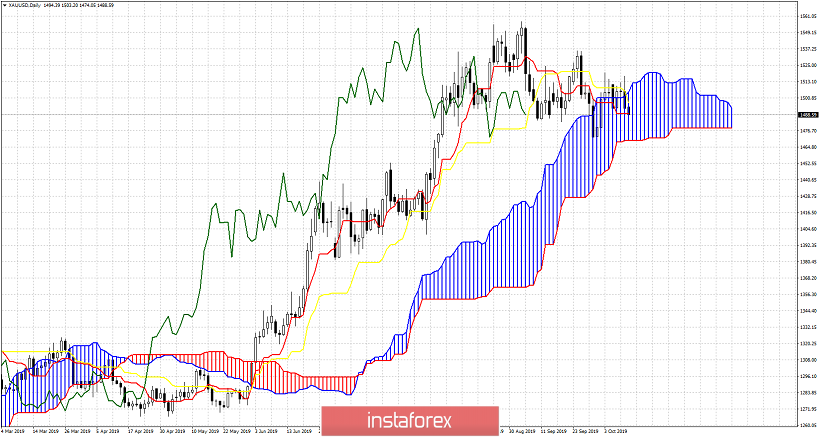

According to the Daily Ichimoku cloud indicator we have more bearish signs than bullish ones. Price is making lower lows and lower highs. Price has entered inside the Kumo (cloud) turning trend to neutral. A break below the lower cloud boundary will turn trend to bearish. However we have some bearish signals before price breaks below the cloud. Price has broken below both the tenkan- sen and the kijun-sen, unable to stay above them despite the recent bounce. The Chikou span (green line indicator) is below Price signifying short-term trend is bearish. All the above change on a break above $1,525-35 resistance area. Until then we remain bearish.