Overview:

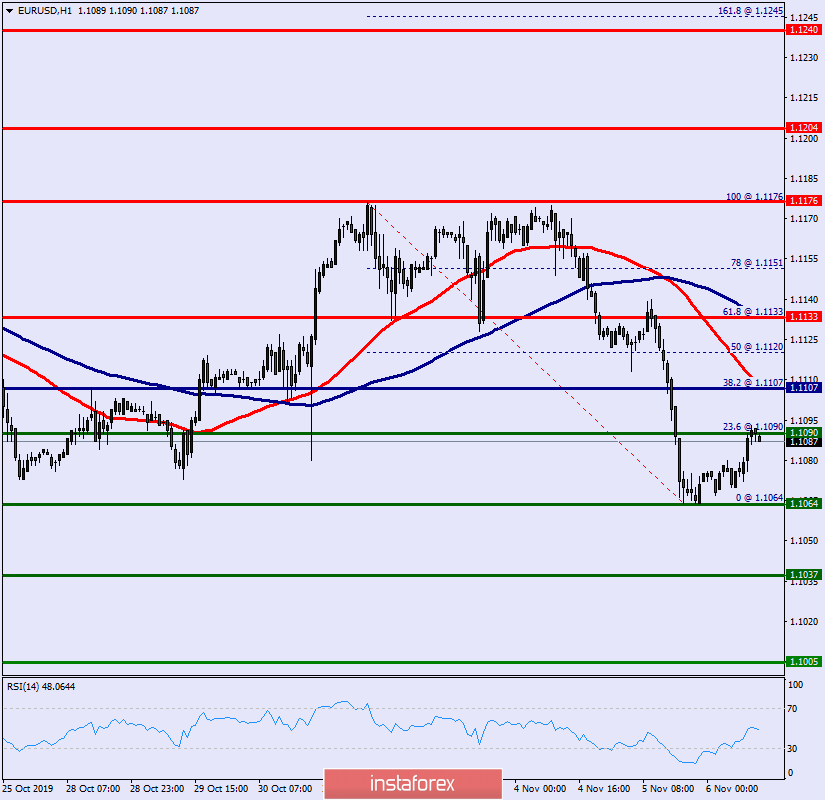

The EUR/USD pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point (1.1107).

In larger time frames the trend is still bullish as long as the level of 1.1107 is not violated

The support levelof 1.1107 has been rejected two times confirming the veracity of an uptrend.

A daily closure beow 1.1107 allows the pair to make a quick bearish movement towards the next support level around 1.1064.

The bearish outlook remains the same, as long as the 100 EMA is pointing to the downside.

The depicted resistance level of 1.1107 acted as a prominent key level offering a valid sell entry.

Short positions are recommended with the first target at 1.1107. A break of that target will move the pair further downwards to 1.1064.

If the trend is able to breakout through the first resistance level of 1.1064. We should see the pair rising towards the second support level of 1.1037.

However, traders should watch for any signs of bullish rejection that occur around .1133. It would also be wise to consider where to place a stop loss; this should be set above the second resistance of 1.1037.