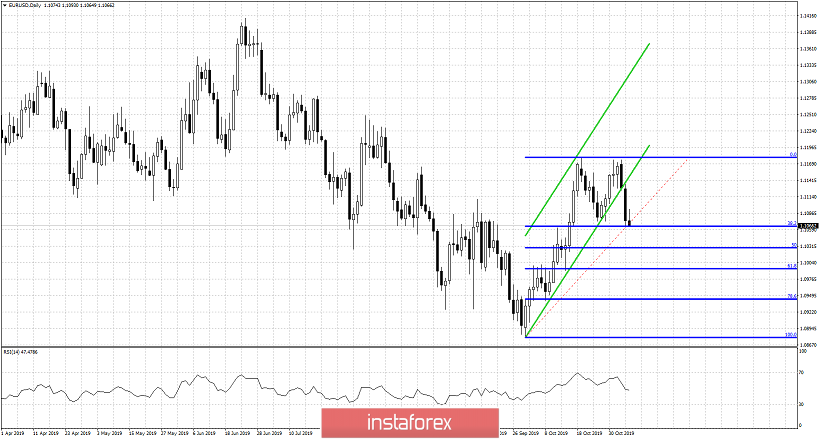

EURUSD has broken out and below the short-term bullish channel and is now challenging the 38% Fibonacci retracement of its recent move higher. Bears seem to be in control of the short-term trend and if price breaks below 1.1060 I would expect more downside to be seen soon.

EURUSD is at the 38% Fibonacci level. This is important support. Breaking below it will push price towards 1.1025 or 1.10 which are the next two important support levels. Resistance remains key at 1.1130 and above that the important resistance is the double top at 1.1180 area. The most probable scenario for me is to see price pull back towards 1.10 in order to make a higher low relative to the September lows. I see nothing bullish right now so I prefer to be neutral.