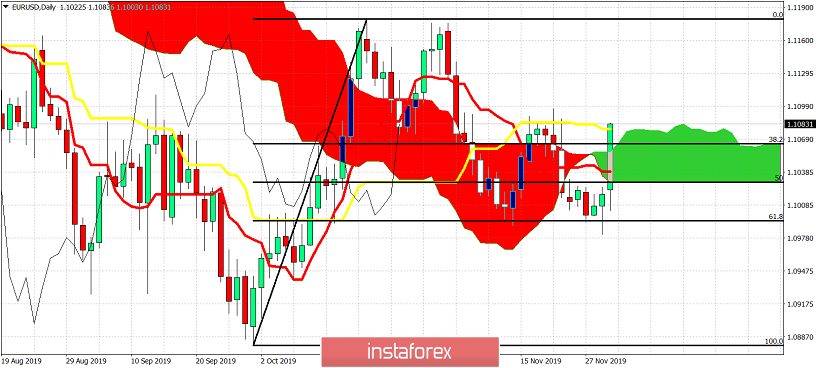

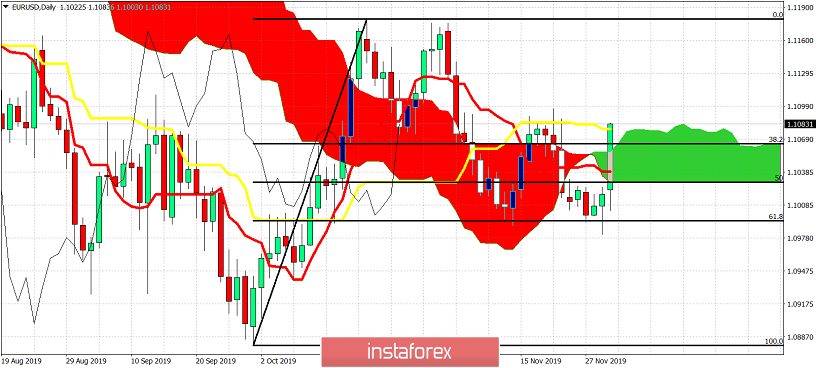

In previous posts we noted that the bullish divergence and price setup in EURUSD was pointing to at least a short-term reversal above 1.1030 towards 1.11. December starts with a move higher in EURUSD and a reversal from major Fibonacci retracement level.

EURUSD has reversed its short-term at 1.10 where we find the 61.8% Fibonacci retracement of the latest leg up. Price is also breaking above the Ichimoku cloud on a daily basis and this is another bullish signal. The RSI bullish divergence has warned bears not to be greedy and that a reversal bounce was coming. Today all this has been confirmed today. Bulls need to hold above 1.1030-1.10 otherwise we should expect a move towards 1.09 and lower. Resistance is at 1.11. Support is at 1.1060 and next at 1.10.