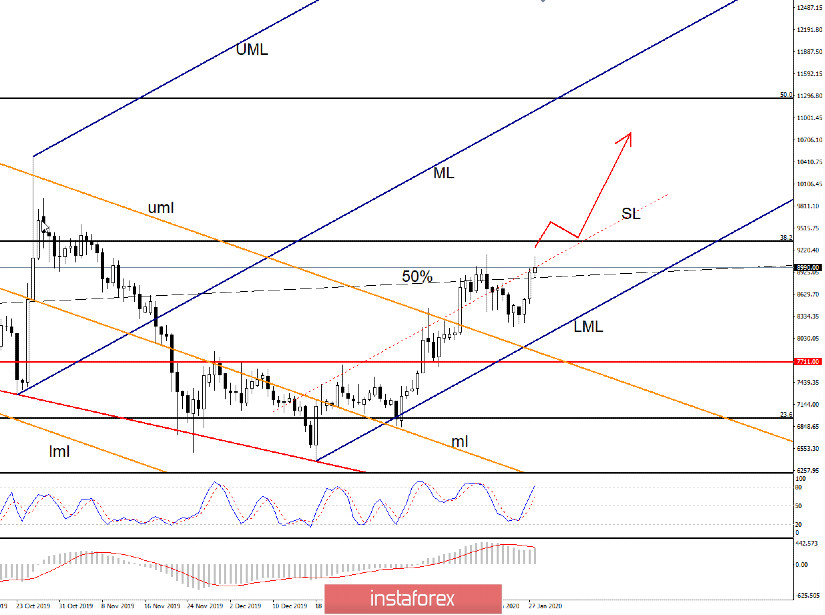

Bitcoin has decreased a little in the previous days, but the outlook remains bullish for the short term. BTC/USD has failed to retest the lower median line (LML) of the ascending pitchfork (dark blue) and now has jumped above the 50% Fibonacci line (ascending dotted line).

You can see that the price has managed to escape from the descending pitchfork's body (orange) as the BTC quote has failed to reach the lower median line (lml), MACD has indicated a bullish divergence on the Daily chart.

I've drawn the ascending pitchfork (dark blue) to catch the potential upside movement. So, the outlook is bullish as long as the price stays above the lower median line (LML). BTC/USD is expected to jump much higher if it makes another higher high in the upcoming hours.

Trading Recommendations

We'll have a great opportunity to go long on BTC/USD if the price makes a valid breakout above the 38.2% ($9,340) retracement level and if it stabilizes above the sliding line (SL). If you decide go buy Bitcoin above $9,340 (38.2%), you should place a Stop Loss below the LML, maybe below $7,711.

The next upside targets are at the 50% retracement level and at the median line (ML) of the ascending pitchfork. So, a valid breakout and another higher high could send BTC/USD way above the $10,000 psychological level.

The potential upside movement will be invalidated if the price fails to close and stabilizes above the sliding line (SL), above $9,162 former high and most important if it fails to make a valid breakout above the 38.2% retracement level. A selling opportunity could appear if BTC/USD drops below the $7,711 support level.