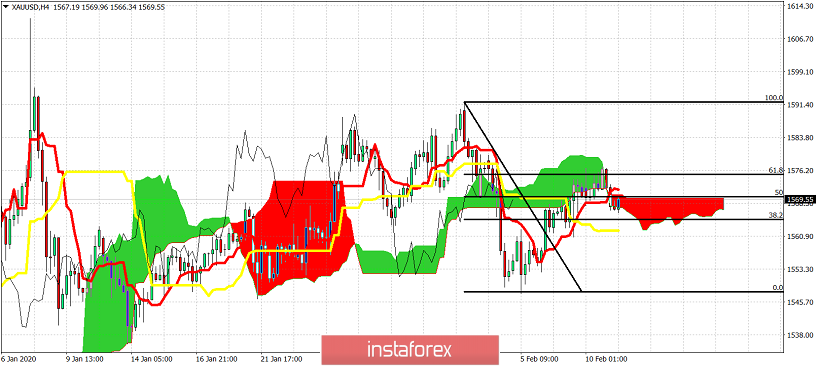

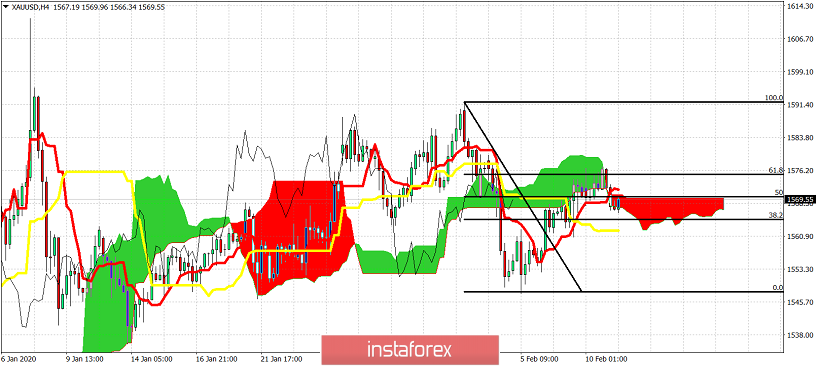

Gold price has tested the short-term resistance at $1,575-$1,580 and now it shows rejection signs. Price is reversing at important Fibonacci and cloud resistance area.

Gold price has tested the short-term resistance at $1,575-$1,580 and now it shows rejection signs. Price is reversing at important Fibonacci and cloud resistance area.