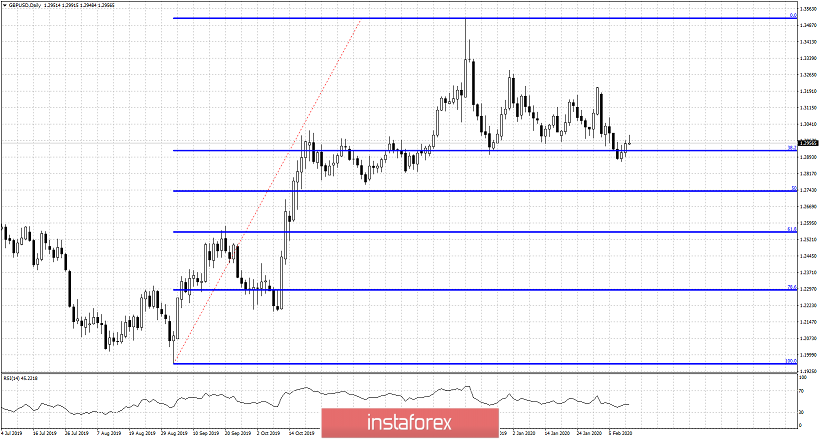

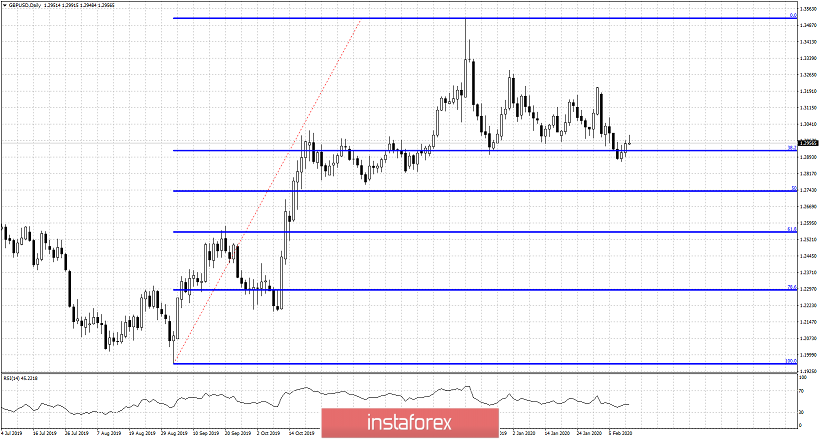

GBPUSD remains vulnerable to a move lower. Price bounced off the 38% Fibonacci retracement of the longer-term upward move from 1.1958 to 1.3514. Price is in bearish trend also in the short-term and I continue to expect price move lower.

GBPUSD remains vulnerable to a move lower. Price bounced off the 38% Fibonacci retracement of the longer-term upward move from 1.1958 to 1.3514. Price is in bearish trend also in the short-term and I continue to expect price move lower.