Gold price plunged on Friday, thus erasing some of the latest gains, but the outlook is still bullish despite the current drop. A correction came as no suprise after the impressive rally. The yellow metal decreased as much as 1,562 on Friday, but it closed higher at $1,584. Gold tumbled by 4.95% in the previous session, but the bulls are still in the game, fighting hard to push the price higher in the current session.

The global risk maintains a bullish outlook for Gold. That's why is hard to talk about a broader corrective phase, the current drop could be only a temporary one before the price climbs higher again.

Gold has opened with a gap up today, the price is trading at 1,603, right above the 1,600 psychological level. The question is if the price has completed the downside movement, or we'll see a larger drop after a temporary rebound?

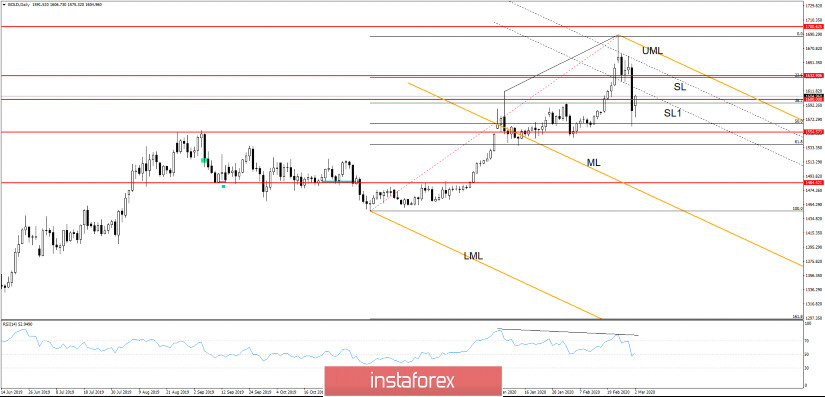

You can see that the price has registered only a false breakdown with a great separation below the 50% retracement level and now it is approaching the sliding line (SL1) which is acting as a dynamic resistance (support turned into resistance).

The corrective phase was natural after the price has developed a Shooting Star (Pin Bar). This pattern was confirmed by a bearish candle, RSI indicator has signaled a bearish divergence, while the price has closed the gap up. Gold will be able to drop deeper if the price stabilizes below the 1,600 psychological level.

I've drawn a descending pitchfork hoping that I'll catch a potential downside movemen. The price has failed to test and retest the upper median line (UML) signaling bearish pressure. So, Gold is set to extend weakness as long as the price stays below the SL1 and below the SL. Gold has failed to reach the 1,554 static support

- TRADING RECOMMENDATIONS

GOLD should drop deeper if it stabilizes below the $1,600, below the sliding line (SL1), and below the 38.2% retracement level. A rejection from the SL1 could send the price down again and maybe it will approach the 1,554 level.

I believe that a further climb towards fresh new highs it will be confirmed only after a valid breakout above the upper median line (UML) of the descending pitchfork. Till then, the precious metal is trading under bearish pressure, but a broader corrective phase will be confirmed only after a valid breakdown below the 50% retracement level and below the 1,554 static support. The major downside target is seen at the median line (ML).