EUR/USD has decreased a little on the short term after the failure to stabilize above the 1.1448 static resistance. A correction was somehow natural after the amazing upside movement. It remains to see how EUR/USD will react tomorrow after the ECB meeting.

EUR/USD could take a hit if the ECB takes action tomorrow and if they decide to add more stimulus measures to combat the coronavirus effects. COVID-19 makes new victims in Europe, this situation could escalate and the eurozone economy could suffer. That's why the euro could depreciate versus the US dollar, which remains a safe-haven currency.

EUR/USD increased last week only because of the dollar's weakness, but not because the euro was strong. The epidemic in Europe could hit the euro, so the currency could drop versus the USD, JPY and CHF.

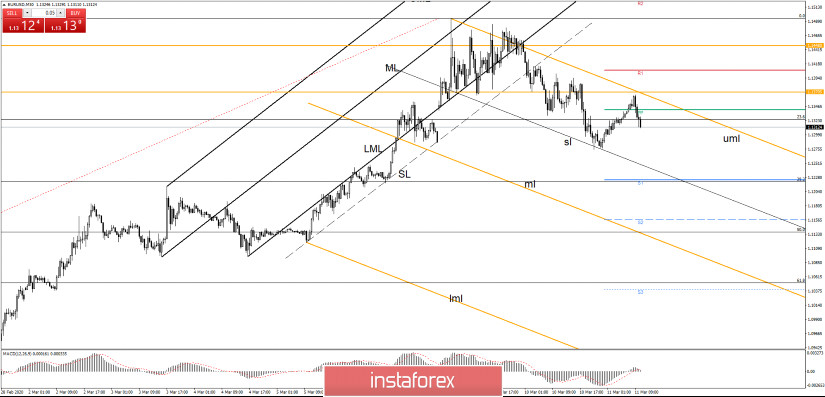

EUR/USD is moving down between the upper median line (uml) and the inside sliding line (sl) of the orange descending pitchfork, the outlook is bearish in the short term as long as the price stays within this down channel. The price has failed to stabilize above the 1.1448, it has broken below the outside sliding line (SL) of the minor black ascending pitchfork and below the 1.1370 critical support.

The USD has taken the lead as the USDX has managed to jump higher, the index has closed Monday's gap down. Now the index is trading above the 96.00 psychological level. The US dollar index was rejected from a major dynamic resistance, so a further increase will send EUR/USD towards new lows on the short term.

- TRADING TIPS

EUR/USD will resume the upside movement only after a valid breakout above the upper median line (uml) of the orange descending pitchfork. It could drop at least till the 38.2% retracement level and S1 (1.1223) if it stays below the 23.6% level, below the Pivot Point (1.1340) and below the upper median line (uml).

Technically, the failure to reach and retest the upper median line (ml) is signaling a bearish pressure and a potential drop towards the inside sliding line (sl). A valid breakdown below the 38.2%, S1 and below the sliding line (sl) will confirm a larger EUR/USD drop, S2 (1.1157), 50% level and the median line (ml) are seen as next downside targets.

You can go long only after a valid breakout from the down channel, above the upper median line (uml) and after EUR/USD closes again above the 1.1370.