Gold dropped by approx 3.43% in yesterday's trading session as the USDX has managed to extend its rally. The sell-off was accelerated by the ECB decision to add stimulus measures, but gold maintains a bullish outlook despite the last drop.

Price has decreased as much as $1,551.26 today, it has registered only a false breakdown below the $1,555 major static support and now is fighting hard to recover. Gold has developed a bullish engulfing pattern right on the $1,555 downside obstacle and now is almost to reach the $1,600 psychological level again.

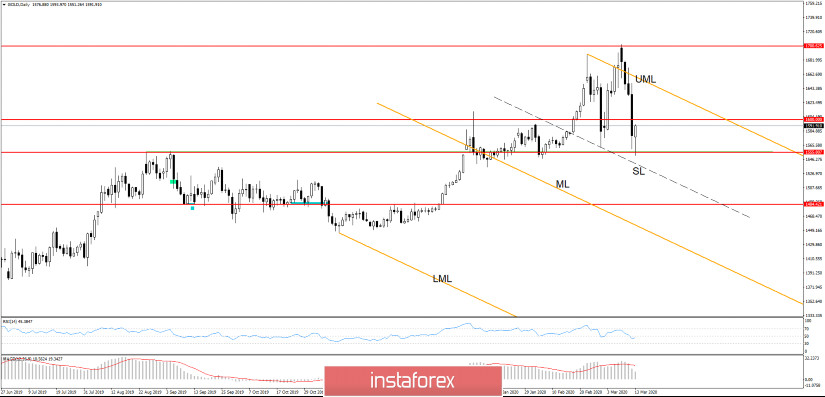

Gold has declined after the failure to close above the $1,700 level and after the price has managed to close Monday's gap up. I've said in my previous analysis that the price could drop on the short term, also after the failure to stabilize above the upper median line (UML).

The correction was somehow natural also because MACD and RSI have signaled a bearish divergence and an overbought situation. Gold has failed to reach the inside sliding line (SL) of the orange descending pitchfork, it could come back above the $1,600 level if it stays away from the $1,555 support.

- TRADING TIPS

The outlook is bullish as long as Gold is traded above the $1,555 level, but you should know that only a valid breakout above the upper median line (UML) will really validate a further increase at least till the $1,703 previous high.

On the other hand, a larger correction will be confirmed by a valid breakdown below the $1,555 static support. A consolidation above the critical support followed by a valid breakout above the upper median line (uml) will give us a great chance to go long again. I believe that a reversal on Gold will be confirmed only below the $1,484.