Minutes ago the FED announced that its cutting rates to zero and the launch of a $700billion quantitative easing program. This will at least initially put USD under lots of pressure. As we explained in our last analysis EURUSD bulls want to see a higher low.

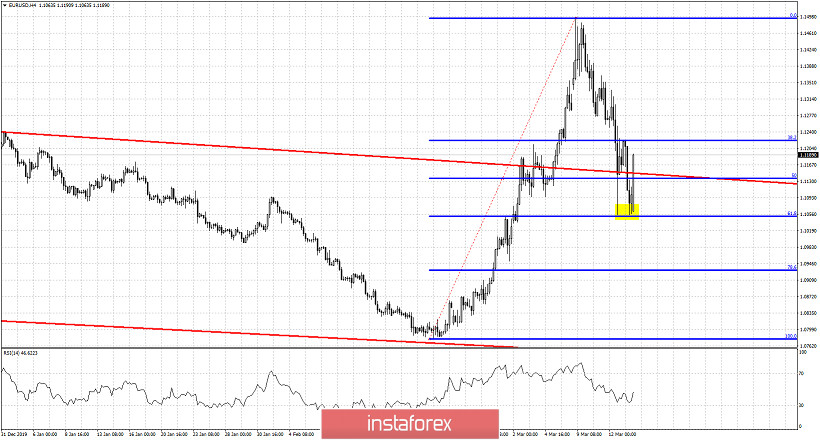

Blue lines -Fibonacci retracement

Yellow rectangle- key support level

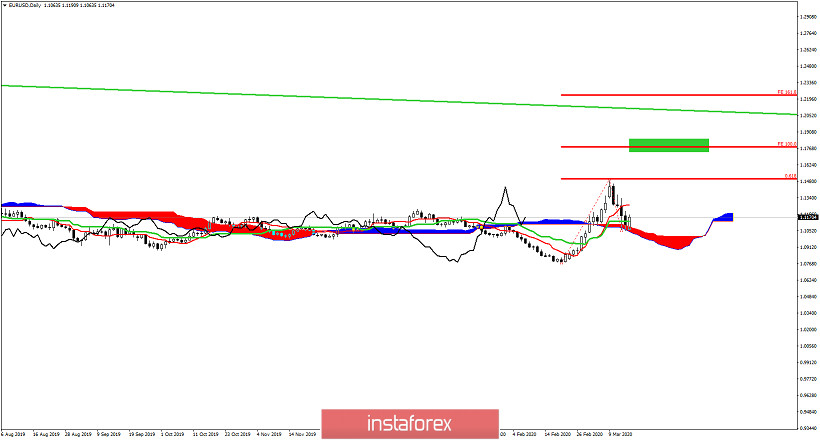

EURUSD is bouncing again after the FED intervention. Price had stopped at a major support level as we explained in our last analysis. EURUSD could very well have formed a higher low and could now start its new upward move that will eventually push price towards 1.17-1.18. For this to come true we need to see a sequence of higher highs and higher lows. At the same time we should not see price break below the yellow rectangle area and last week's lows.

Key short-term support is at 1.1050. Bulls do not want to see this level broken. We are bullish as long as price is above this level.