Overview:

Pair : GBP/USD.

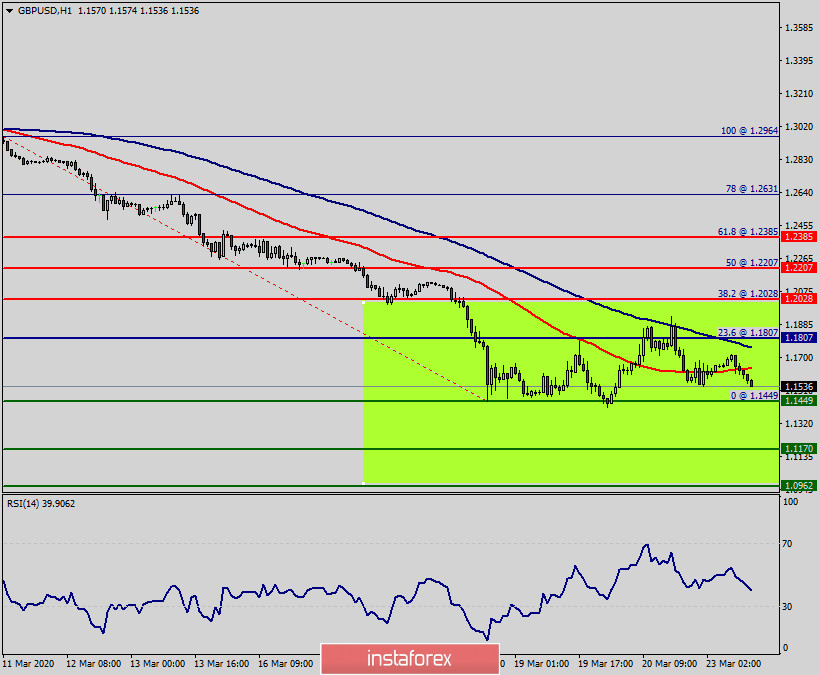

Trend : bearish market.

The GBP/USD pair suffers its worst weekly loss because the Coronavirus crisis.

The GBP/USD pair bears catch a breath near the lowest levels since October 2019.

Following its drop to the lowest in 6 months, the GBP/USD pair struggles for direction while taking rounds to 1.1449.

Is Brexit more dangerous than coronavirus for the pound? That what will know in coming days.

Technically:

Pivot: 1.1817.

The trend is still bearish as long as the level of 1.1817 is not broken. The level of 1.1600 has been rejected several times confirming the validity of a bearish market today. So, the first resistance is seen at 1.6000 . The market is still indicating a strong bearish trend from the spot of 1.1600. Thereupon, it would be wise to sell below the level of at 1.1600 with the primary target at 1.1445. On the downside, a clear break below 1.1449 could trigger further bearish pressure testing 1.1449, which coincides with a triple bottom. Then, the trend is keeping its bearish momentum in coming days. As a result, it is gainful to sell below this price with targets at 1.1250 and 1.1170. We expect a new range below the area of 1.1449 towards the daily support of 1.1449. The bias remains bearish in the nearest term testing 1.1250 and 1.1170. Consequently, the GBP/USD pair will probably be moved between the levels of 1.1533 and 1.1170. The stop loss has always been in consideration. Hence, it will be useful to set it above the resistance of 1.1807.