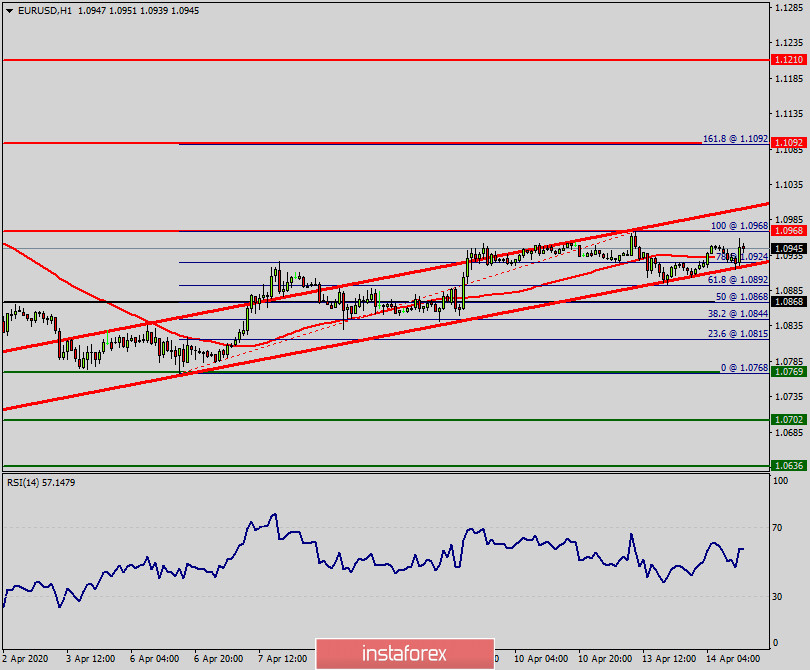

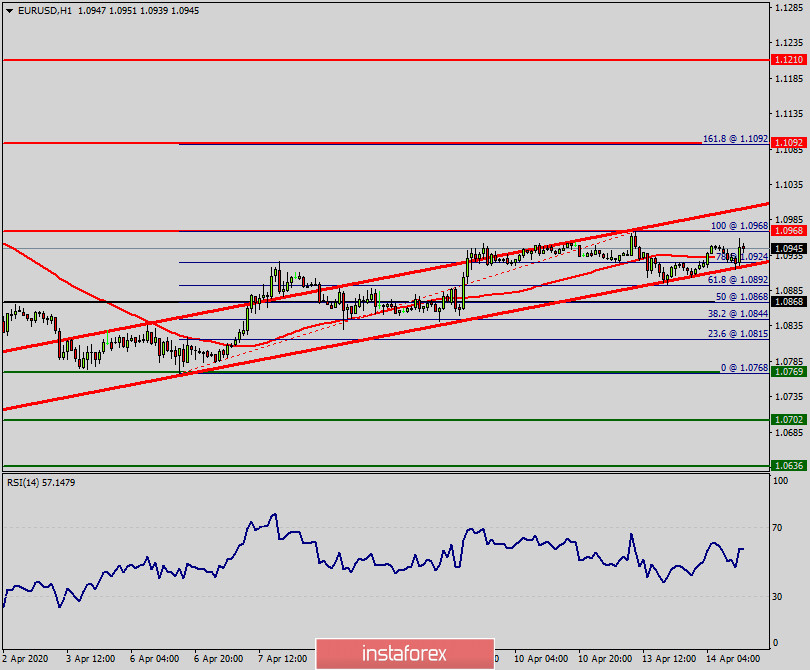

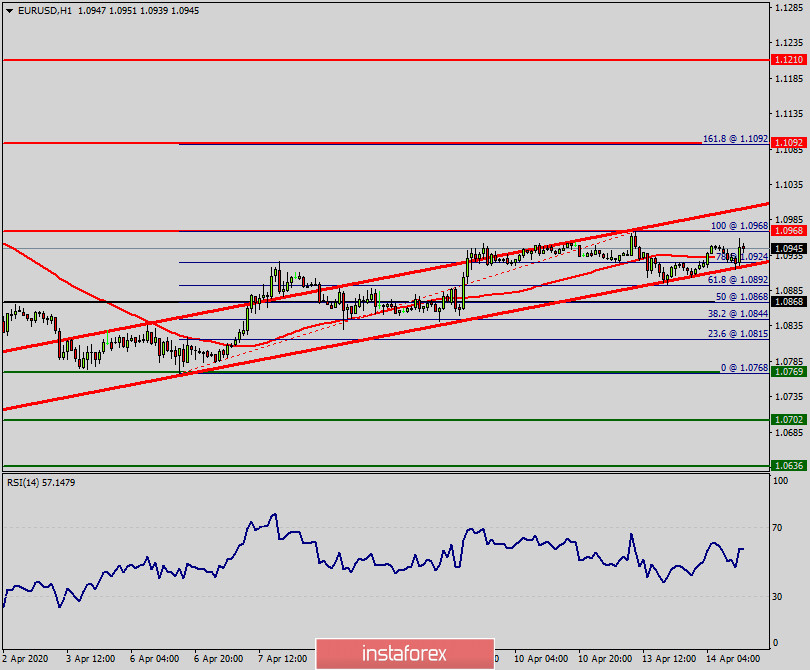

Overview: Statistical data seems to lag behind the fast-moving Coronavirus (Covid 19) which is wreaking havoc around the world. But the EUR/USD pair rose above the level of 1.0769 yesterday and is struggling to recover as Germany is warming up toward European-wide bonds. Probably a more comprehensive plan from the eurozone and a stop in additional lockdowns could help the euro settle. The EUR/USD pair continues to move in an uptrend from the level of 1.0769 since yesterday. So, major support is seen at 1.0769, while immediate resistance is found at 1.0968. Besides, it should be noted that the support coincides with the double bottom. Today, we guess that the pair will be traded higher in the early session and try to reach the first resistance at the level of 1.0968. The bias is neutral in the nearest term probably with a little bullish bias testing 1.0968 area which needs to be clearly broken to the upside to keep the bullish scenario strong. A clear break above that area (1.0968) could lead the price to the neutral zone in the nearest term testing 1.1092. Thus, we confirm the bullish scenario. On the downside, a clear break and daily close below 1.1000 could trigger further bearish pressure testing 1.0868 which represents a weekly pivot point. Consequently, the EUR/USD pair is able to close below the support of 1.0868 on the one-hour chart; the trend will continue its bearish momentum today. As a result, it is gainful to sell below the 1.1000 price with targets at 1.0868 and 1.0769. However, the bullish trend is still expected for the upcoming hours as long as the price is above 1.076 9level.