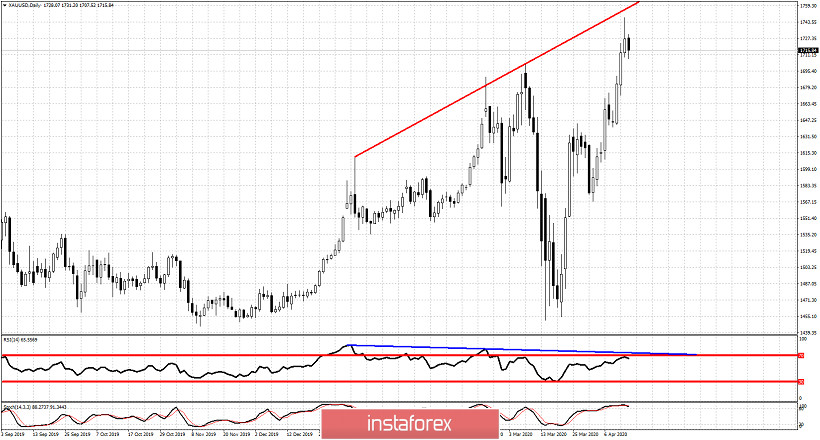

Gold price is turning lower. Price made a high at $1,747 and is now trading near $30 lower. Gold price remains in a bullish trend but as we explained in previous post, Gold is vulnerable to making an important top. Technically we have warning signs in the Daily chart.

Blue line - lower high

The RSI in the Daily chart has provided us with a bearish divergence. The lower high in the RSI combined with the higher high in price is a typical divergence. This is a major warning. Price has the potential to make an important top at current levels. Bulls need to be very cautious and protect their profits. I would not be surprised to see Gold break below $1,700 soon.

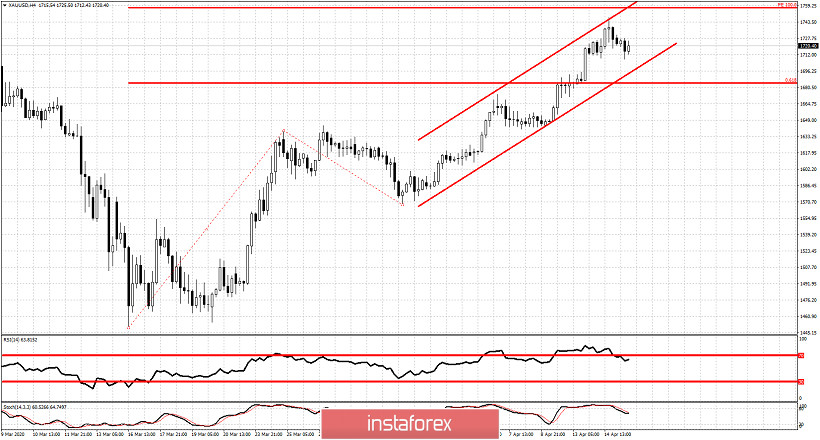

Gold price is still inside a short-term bullish channel. Support is at $1,700. Breaking below it will be a bearish sign. Additionally the chances of at least a short-term top are high because of the short-term bearish divergence signs and because the entire upward move from $1,570 has reached almost 100% equality of the first leg up from $1.440 to $1,643.

It is time to be cautious. Not chase the bullish trend.