EUR/USD drops like a rock as the French and German Flash Services PMI and Flash Manufacturing PMI data have come in worse than expected. The numbers have shown a big contraction in both sectors, this situation could depreciate the euro. The services sector was seriously affected by COVID-19 pandemic and I believe that EUR is doomed to lose ground versus the other major currencies.

The eurozone and the US Flash Manufacturing PMI and Flash Services PMI data will be published later, it remains to see how EUR/USD will react. The US Unemployment Claims will be released as well today, but the dollar could remain strong despite some poor data.

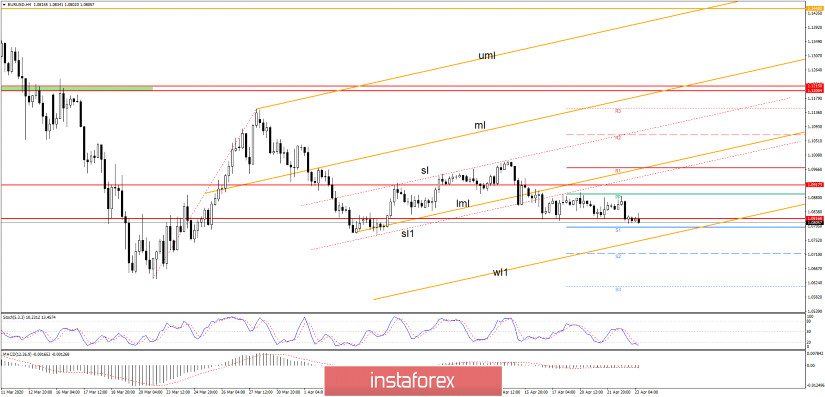

EUR/USD was trapped within an extended sideways movement, but it seems too heavy to stay above the 1.0816 support. It could resume the downside movement after this distribution movement.

The price tested and retested the weekly Pivot Point (1.0891) level, but it has failed to close above it signaling a selling pressure. Technically, it was somehow expected to drop further after the breakdown below the lower median line (lml) of the ascending pitchfork. A further drop could be confirmed by a valid breakdown below the S1 (1.0791) level.

The next downside target is seen at the first warning line (wl1) of the ascending pitchfork, a breakdown through this potential dynamic support will validate a further drop towards the 1.0654 static support.

- TRADING TIPS

Maybe you should stay away because the economic data will bring high volatility today. However, EUR/USD could drop further if it stabilizes below 1.0816 and if it closes below the S1 (1.0791) level.

A further decrease could be invalidated if the breakdown below 1.0816 will be a false one, if the price develops a bullish engulfing or a pin bar in this area. I've said in my previous analysis that EUR/USD is bearish as long as it stays below 1.0917.

The Dollar has taken full control again as the USDX has rallied today and it has managed to reach new highs. The USDX is traded at 100.51, a further increase will push the EUR/USD way lower, towards new downside targets. The weekly S2 (1.0712) and the S3 (1.0612) could be used as short term downside targets as well.