That's when the pair looked very OVERSOLD around the price levels of 1.1450 where a double-bottom reversal pattern was demonstrated.

Bullish breakout above 1.1900 invalidated the bearish scenario temporarily & enabled a quick bullish movement to occur towards 1.2260.

Technical outlook remains bullish as long as bullish persistence is maintained above 1.1890-1.1900 (Double-Bottom Neckline) on the H4 Charts.

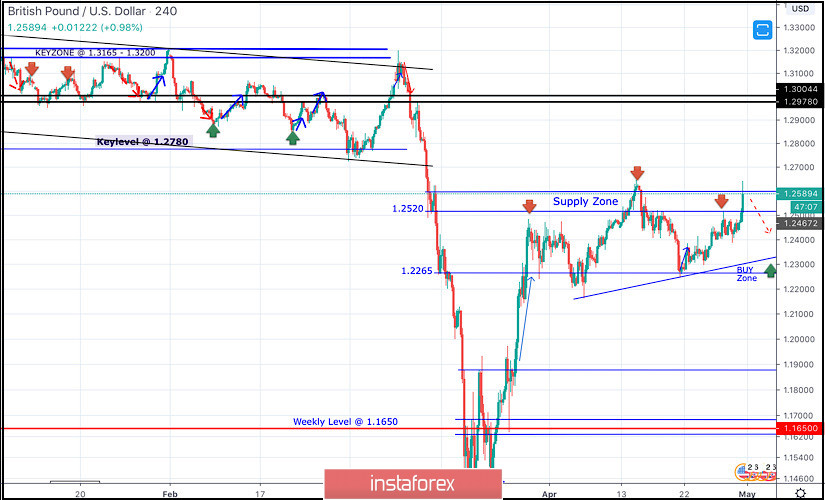

Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April).

Currently, A Bearish Head & Shoulders reversal pattern may be in progress. The pair may be demonstrating the right shoulder of the pattern.

Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to enhance another bearish movement towards 1.2100, 1.2000 then 1.1920. However, the ongoing bullish price action is quite strong and this should be taken into consideration.

That's why, any form of bullish breakout above 1.2600 brings more bullish momentum into the market.

Conservative BUYERS should be waiting for bearish pullback towards the price levels of 1.2300-1.2360 where a low risk/reward BUY trade can be offered.

Trade recommendations :

Intraday traders should be looking for bearish rejection around the current Supply-Zone (1.1550-1.2600) as a short-term SELL signal.

However, conservative ones should wait for possible upcoming bearish breakout below 1.2265 (Pattern Neckline) as a valid SELL entry.

T/P level to be located around 1.2270, 1.2100, 1.2000 then 1.1920 while short-term Sellers should place their Exit / SL level slightly above 1.2600.