USD/CHF is trading in the green as the USDX has managed to rebound and to come back higher in the short term. More good US data could push the pair way higher in the upcoming period.

The pair is bullish despite the last drop, the price action suggests a further increase in the short term. However, the dollar could lose ground again if the US data disappoints today and tomorrow. The Non-Farm Payrolls and the Unemployment Rate will definitely shake the markets, whereas positive figures will boost the dollar.

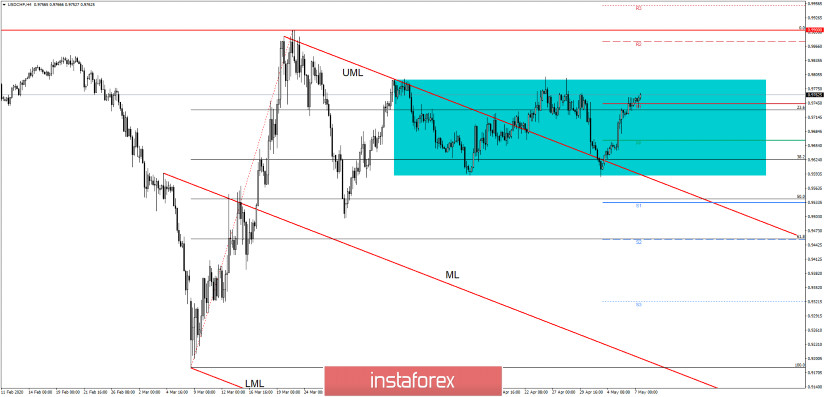

USD/CHF has rallied after the false breakdown below the upper median line (UML) and below the 38.2% level and now has crossed above 23.6% and beyond the weekly R1 (0.9743) level. A stabilization above these two obstacles will confirm a further increase.

I've said in my analyses that a valid breakout above the upper median line (UML) will suggest an increase towards the 0.9899 high as the price has failed to approach and reach the median line (ML) of the descending pitchfork.

- TRADING TIPS

The next upside target is seen at the 0.9794 static resistance, but it could approach also the R2 (0.9875) and the 0.9899 high if the USDX resumes the bullish movement. The breakout above the 23.6% level and above the R1 (0.9743) seems valid, so this could be a bullish signal.

Another long opportunity could be confirmed if the price escapes a trading range between 0.9794 and 0.9591 levels. If this scenario takes shape, USD/CHF could target the 1.0000 psychological level again.

USD/CHF is bullish as long as it stays above the 38.2% retracement level, you could search for a short position in the short term if the price makes another false breakout with a great separation above the 0.9794 level. Meanwhile, the outlook is bullish.

The failure to stabilize below the 38.2% and below the upper median line (UML) has announced a broader leg higher, that's why I believe USD/CHF has prospects for a further increase.