Gold has failed once again to confirm a further increase, but for now, the outlook remains bullish, despite Friday's drop. The price is traded at $1,706.53 level that is located in the buyer's territory, but I'm afraid that a failure to breakout above the $1,723 high these days will attract more sellers, which will lead the price down in the short term.

The COVID-19 fear could diminish in the weeks ahead, the positive sentiment and a risk-on could push the gold price lower in the short term as the traders and investors could exit their long position on Gold and invest in riskier assets/instruments. Gold was punished by the USD's strength after the NFP, Unemployment Rate, and the Average Hourly Earnings have come in better than expected on Friday.

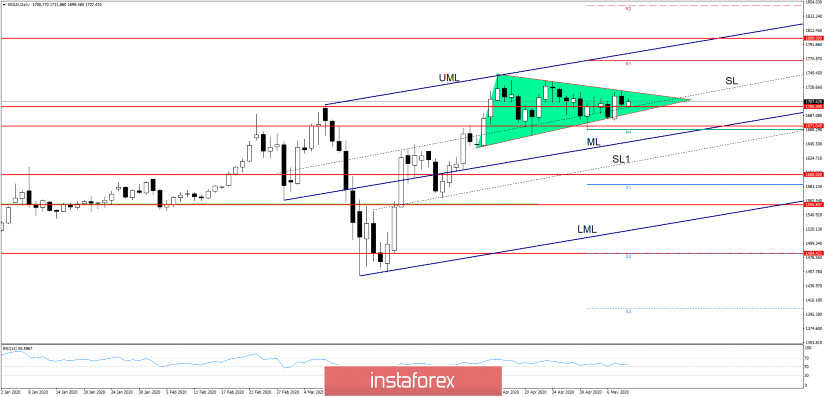

The yellow metal seems undecided on the Daily chart, located within a chart pattern. It was rejected by the minor downtrend line and now retests the $1,700 psychological level and the inside sliding line (SL).

The outlook is bullish as long as the price is traded above the $1,700 level and above the sliding line (SL). Unfortunately, the last week's bullish engulfing wasn't confirmed by a bullish candle on Friday.

However, a downside breakout and a drop below the SL will not be enough for us to consider a short position, you could search for short opportunities after a valid breakdown below $1,671 level and below the PP ($1,666) level.

- GOLD TRADING RECOMMENDATIONS

Short position after a valid breakdown below the 1,671 - 1,666 area with potential downside targets at $1,600, $1,555, and lower at the $1,484 levels. The Stop Loss should be placed above the $1,723 former high.

A long (buy) opportunity will appear only after a valid breakout from the minor triangle, above the $1,723 level, the first target will be at the R1 ($1,767) level, while the second target is at the upper median line (UML) and at the $1,800 level. Maybe the Stop Loss should be placed somewhere below the $1,665 level because we could have another false breakdown below the near-term support levels.

Only a valid breakout above the upper median line (UML) and above the $1,800 will validate a further increase towards the R2 (1,848) and higher at R3 (1,949) levels.