Overview:

We noted a high volatility favours the USD and Brexit will be a key in the works as UK dives from COVID-19 with a scarred economy since the new year of 2020.

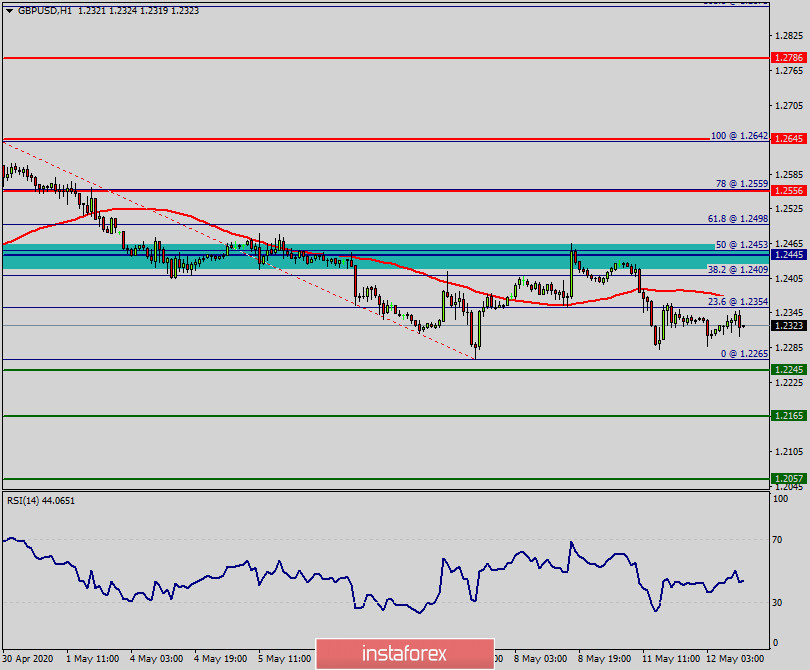

The GBP/USD pair is still trading around the spot of 1.2445 and 1.2245. The GBP/USD pair was moving downwards from the level of 1.2445. The pair dropped from the level of 1.2445 (this level of 1.2445 is coincided with the pivot point) to the bottom around 1.2245. The pair returned to the daily pivot point.

So, current price is set at the price of 1.2445. Today, the first resistance level is seen at 1.2445 followed by 1.2556, while daily support 1 is seen at 1.2245. According to the previous events, the GBP/USD pair is still moving between the levels of 1.2445 and 1.2245; for that we expect a a large range in coming hours.

If the GBP/USD pair fails to break through the resistance level of 1.2445, the market will decline further to 1.2245. This would suggest a bearish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs.

The pair is expected to drop lower towards at least 1.2200 with a view to test the daily major support. On the other hand, if a breakout takes place at the resistance level of 1.2445, then this scenario may become invalidated.