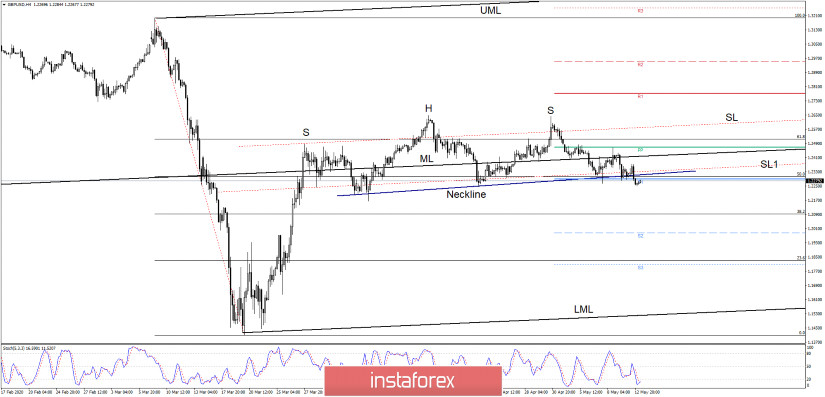

GBP/USD has lost its chance to stay above the near-term support levels, so a potential drop is favored now. The price action signals a Head&Shoulders pattern on the H4 chart, so the outlook is somehow bearish in the short term.

The US dollar remains strong after the NFP, the USDX has decreased a little but it is fighting hard to climb way higher. A USDX's further increase will push GBP/USD down towards new obstacles. It remains to be seen what will really happen because the UK's Prelim GDP was better than expected, at -2.0%, versus the -2.6% forecast, while the GDP decreased by -5.7%, less compared to the -7.9% estimated by the specialists.

The Manufacturing Production, Construction Output, Index of Services, Industrial Production, and the Prelim Business Investment indicators reported better than expected numbers. This situation could save the pound sterling from downside, even if the bias is bearish from the technical viewpoint.

GBP/USD dropped below the H&S neckline, below the 50% retracement level, and under the S1 (1.2288) level, signaling that the selling pressure is high. You can notice that the pair failed to stabilize above the median line (ML), or to close again above the Pivot Point (1.2468) level.

The price changed little rafter the UK's economic data was released. I am expecting to see strong momentum in the upcoming hours. GBP/USD should drop further if it stabilizes below the S1 (1.2288), below the 50% level, and below the uptrend line (Neckline).

- GBP/USD Trading Tips

We'll have a selling opportunity if GBP/USD tests and retests the broken support levels, a false breakout with great separation above the Neckline, S1 and above the 50% level will validate the Head&Shoulders pattern. It will confirm a potential drop towards the 23.5% (1.1829) level and towards the S3 (1.1806) level. Normally, the Stop Loss should be placed above the right shoulder, above the 1.2642. If GBP/USD price will consolidate below the broken downside obstacles, you could place a Stop Loss above the PP and above the 61.8% level.

Right now we have to wait for a confirmation to be sure that the pair will drop further. The UK's data have changed the sentiment in the short term, but as I've just said, support has turned into resistance, so a retest of the broken support levels will validate the pattern and a broader drop.

I believe that only a valid breakout above the upside inside sliding line (SL) of the ascending pitchfork, and another high will invalidate a potential drop and will confirm a further increase on the medium to the long term.